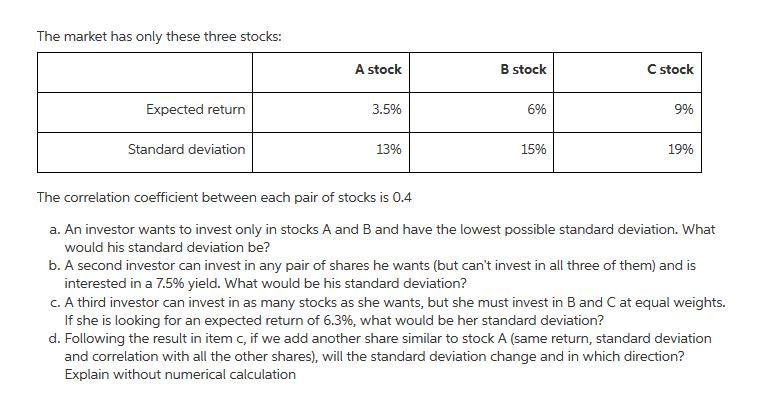

Question: Please Solve c and d The market has only these three stocks: A stock B stock C stock Expected return 3.5% 6% 9% Standard deviation

Please Solve c and d

The market has only these three stocks: A stock B stock C stock Expected return 3.5% 6% 9% Standard deviation 13% 15% 19% The correlation coefficient between each pair of stocks is 0.4 a. An investor wants to invest only in stocks A and B and have the lowest possible standard deviation. What would his standard deviation be? b. A second investor can invest in any pair of shares he wants (but can't invest in all three of them) and is interested in a 7.5% yield. What would be his standard deviation? c. A third investor can invest in as many stocks as she wants, but she must invest in B and C at equal weights. If she is looking for an expected return of 6.3%, what would be her standard deviation? d. Following the result in item c, if we add another share similar to stock A (same return, standard deviation and correlation with all the other shares), will the standard deviation change and in which direction? Explain without numerical calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts