Question: Please solve C and show work for D thank you D The Federal Reserve purchases U.S. Treasury securities to: Treasury securities that mature in 6

Please solve C and show work for D thank you

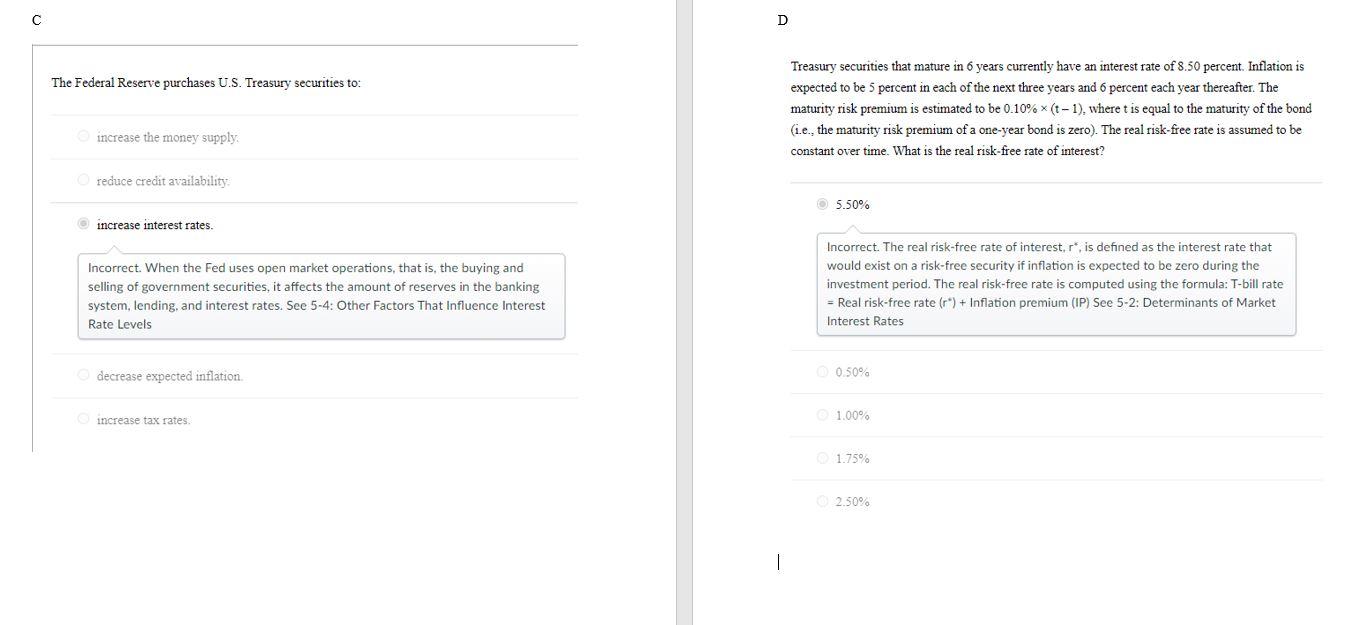

D The Federal Reserve purchases U.S. Treasury securities to: Treasury securities that mature in 6 years currently have an interest rate of 8.50 percent. Inflation is expected to be 5 percent in each of the next three years and 6 percent each year thereafter. The maturity risk premium is estimated to be 0.10% *(t-1), where t is equal to the maturity of the bond (i.e., the maturity risk premium of a one-year bond is zero). The real risk-free rate is assumed to be constant over time. What is the real risk-free rate of interest? increase the money supply reduce credit availability 5.50% increase interest rates. Incorrect. When the Fed uses open market operations, that is, the buying and selling of government securities, it affects the amount of reserves in the banking system, lending, and interest rates. See 5-4: Other Factors That Influence Interest Rate Levels Incorrect. The real risk-free rate of interest, r*, is defined as the interest rate that would exist on a risk-free security if inflation is expected to be zero during the investment period. The real risk-free rate is computed using the formula: T-bill rate = Real risk-free rate (r) + Inflation premium (IP) See 5-2: Determinants of Market Interest Rates decrease expected inflation 0.50% increase tax rates. 1.00% 1.75% 2.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts