Question: Please solve clearly and explain all steps A man buys a 22-year, 496 coupon bond with annual coupon payments and a YTM of 7.5% at

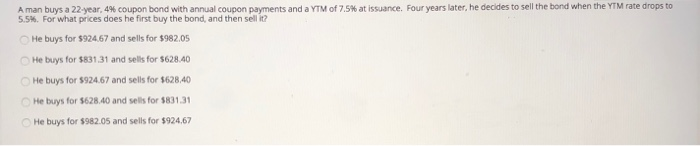

A man buys a 22-year, 496 coupon bond with annual coupon payments and a YTM of 7.5% at issuance. Four vears later, he decides to sell the bond when the YTM rate drops to 5.5%. For what prices does he first buy the bond, and then sell it? He buys for $924.67 and sells for $982.05 He buys for $831.31 and sells for $628.40 He buys for $924.67 and sells for $628.40 He buys for $628.40 and sells for $831.31 He buys for $982.05 and sells for $924.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts