Question: please solve complete in one hour (1) Determine the CAPM beta of the portfolio you constructed in (e). Given your answers to the rest of

please solve complete in one hour

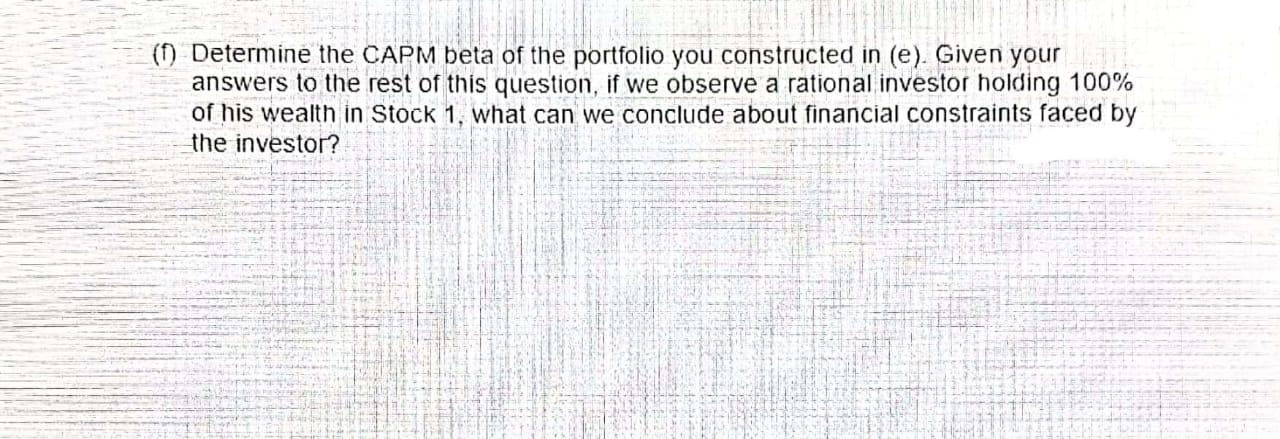

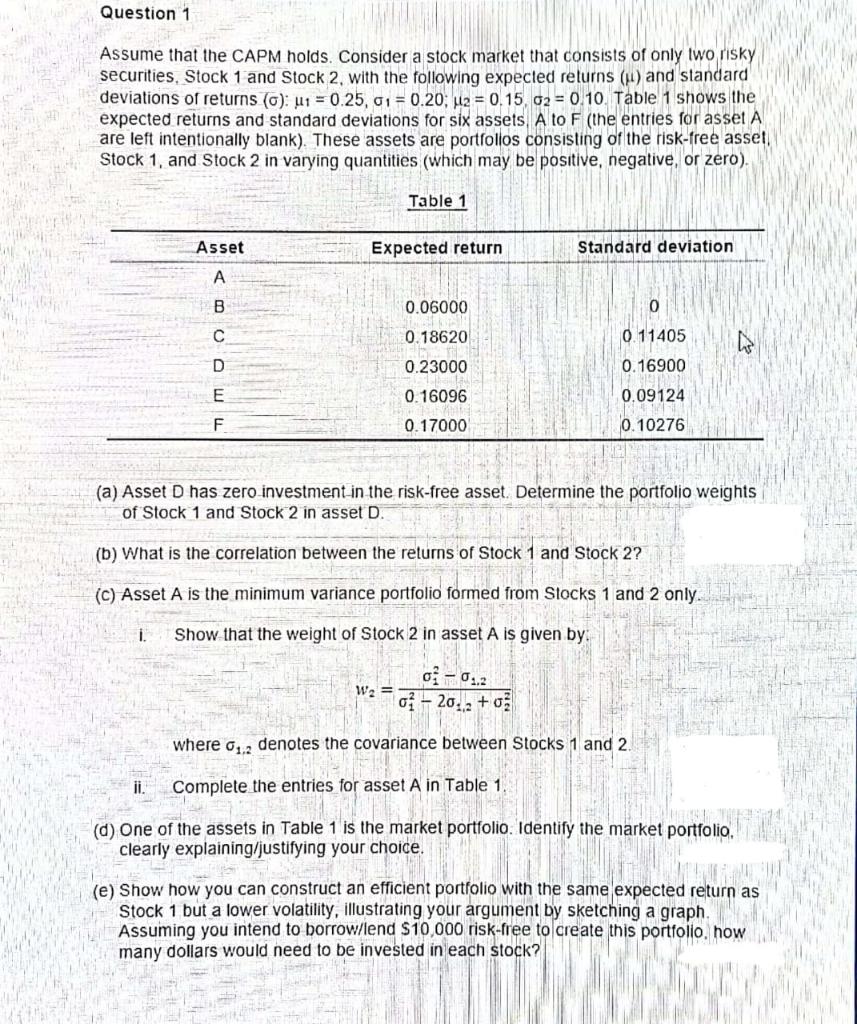

(1) Determine the CAPM beta of the portfolio you constructed in (e). Given your answers to the rest of this question, if we observe a rational investor holding 100% of his wealth in Stock 1, what can we conclude about financial constraints faced by the investor? Question 1 Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock 2, with the following expected returns (1) and standard deviations of returns (C): u1 = 0.25, 01 = 0.20 u2 = 0.15, 62 = 0.10. Table 1 shows the expected returns and standard deviations for six assets. A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset Stock 1, and Stock 2 in varying quantities (which may be positive, negative, or zero), Table 1 Asset Expected return Standard deviation A B 0.06000 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts