Question: please solve complete in one hour Question 1 (a) Proctor Plc. is a computer manufacturing company that is considering diversifying into financial services. This will

please solve complete in one hour

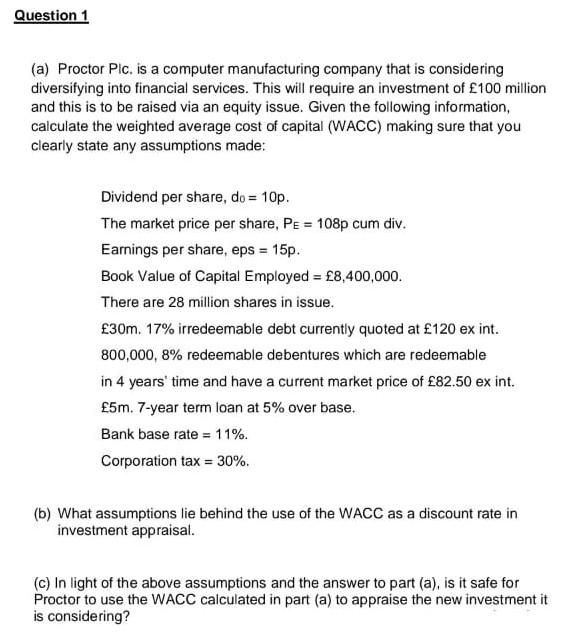

Question 1 (a) Proctor Plc. is a computer manufacturing company that is considering diversifying into financial services. This will require an investment of 100 million and this is to be raised via an equity issue. Given the following information, calculate the weighted average cost of capital (WACC) making sure that you clearly state any assumptions made: Dividend per share, do = 10p. The market price per share, PE = 108p cum div. Earnings per share, eps = 15p. Book Value of Capital Employed = 8,400,000. There are 28 million shares in issue. 30m. 17% irredeemable debt currently quoted at 120 ex int. 800,000, 8% redeemable debentures which are redeemable in 4 years' time and have a current market price of 82.50 ex int. 5m. 7-year term loan at 5% over base. Bank base rate = 11%. Corporation tax = 30% (b) What assumptions lie behind the use of the WACC as a discount rate in investment appraisal. (c) In light of the above assumptions and the answer to part (a), is it safe for Proctor to use the WACC calculated in part (a) to appraise the new investment it is considering? Question 1 (a) Proctor Plc. is a computer manufacturing company that is considering diversifying into financial services. This will require an investment of 100 million and this is to be raised via an equity issue. Given the following information, calculate the weighted average cost of capital (WACC) making sure that you clearly state any assumptions made: Dividend per share, do = 10p. The market price per share, PE = 108p cum div. Earnings per share, eps = 15p. Book Value of Capital Employed = 8,400,000. There are 28 million shares in issue. 30m. 17% irredeemable debt currently quoted at 120 ex int. 800,000, 8% redeemable debentures which are redeemable in 4 years' time and have a current market price of 82.50 ex int. 5m. 7-year term loan at 5% over base. Bank base rate = 11%. Corporation tax = 30% (b) What assumptions lie behind the use of the WACC as a discount rate in investment appraisal. (c) In light of the above assumptions and the answer to part (a), is it safe for Proctor to use the WACC calculated in part (a) to appraise the new investment it is considering

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts