Question: please solve complete within one hour 15. Delta hedging S&P 500 options (26 points) Next, suppose that you are a market maker. As of December

please solve complete within one hour

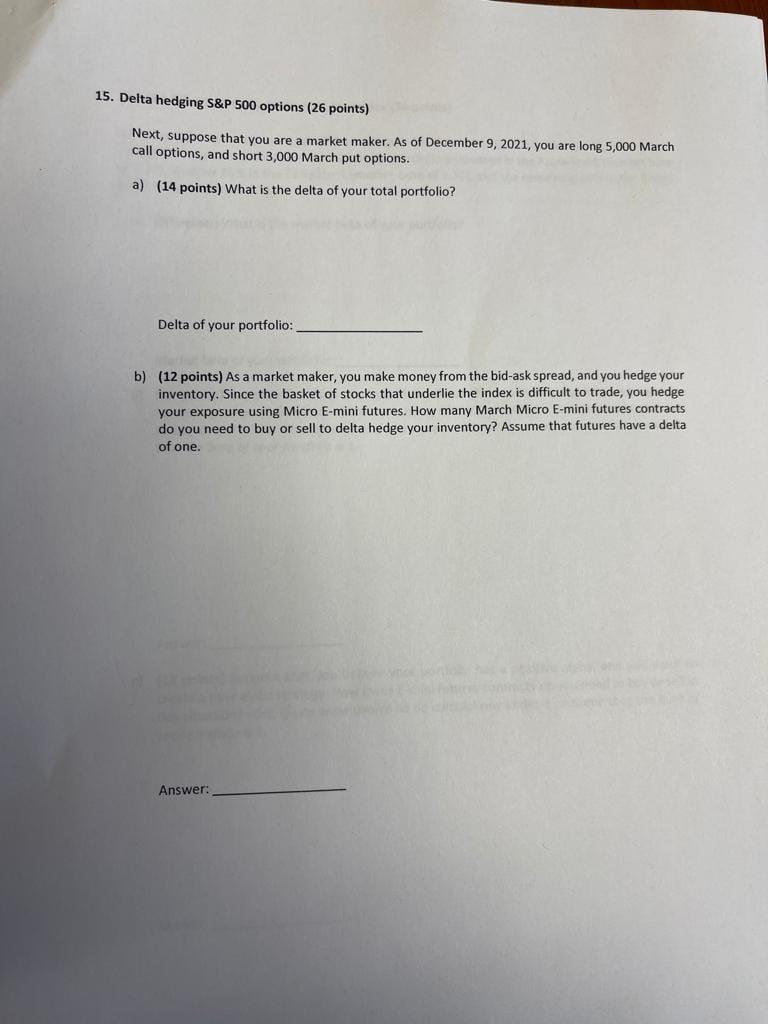

15. Delta hedging S&P 500 options (26 points) Next, suppose that you are a market maker. As of December 9, 2021, you are long 5,000 March call options, and short 3,000 March put options. a) (14 points) What is the delta of your total portfolio? Delta of your portfolio: b) (12 points) As a market maker, you make money from the bid-ask spread, and you hedge your inventory. Since the basket of stocks that underlie the index is difficult to trade, you hedge your exposure using Micro E-mini futures. How many March Micro E-mini futures contracts do you need to buy or sell to delta hedge your inventory? Assume that futures have a delta of one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts