Question: please solve D2. Because Natalie has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is

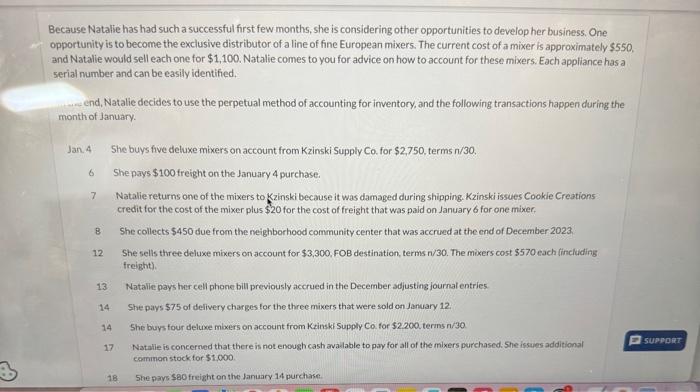

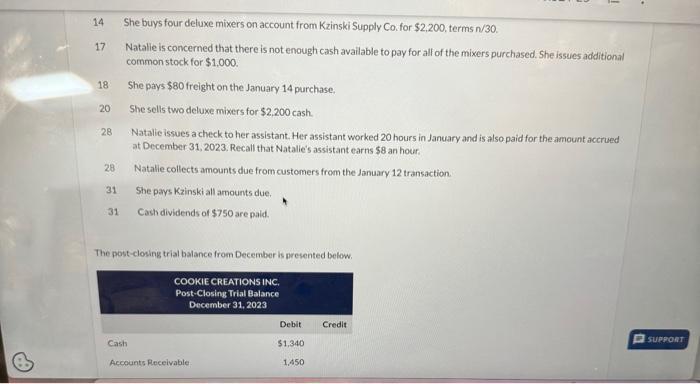

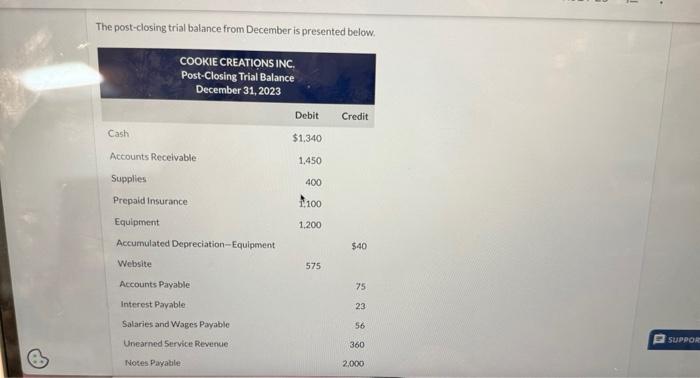

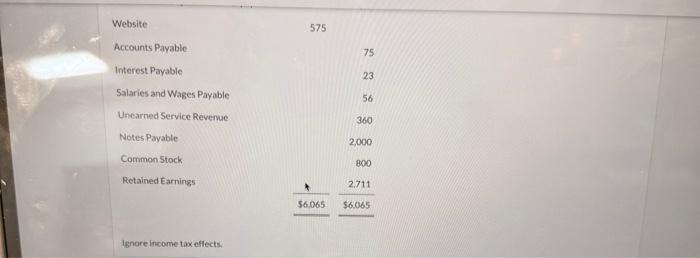

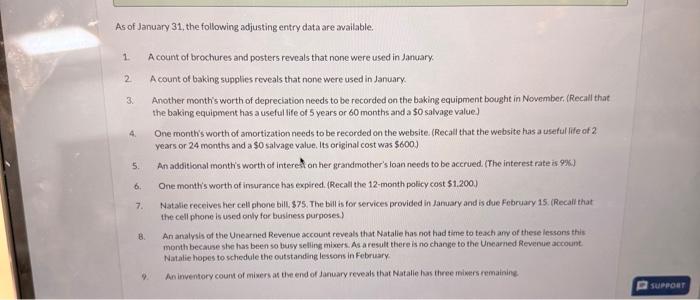

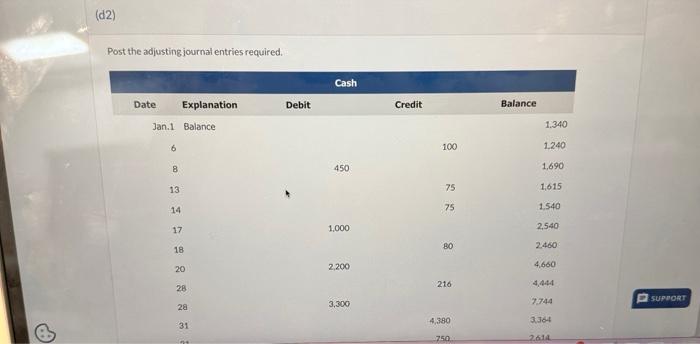

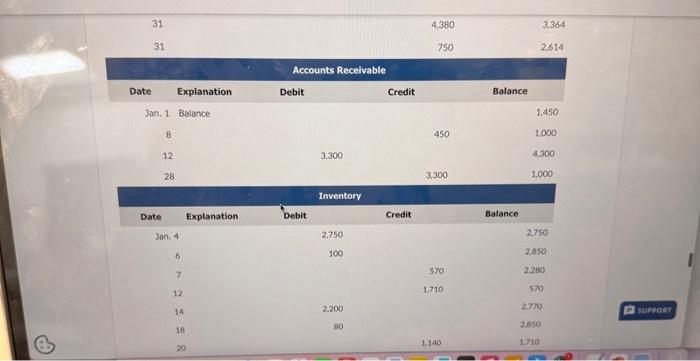

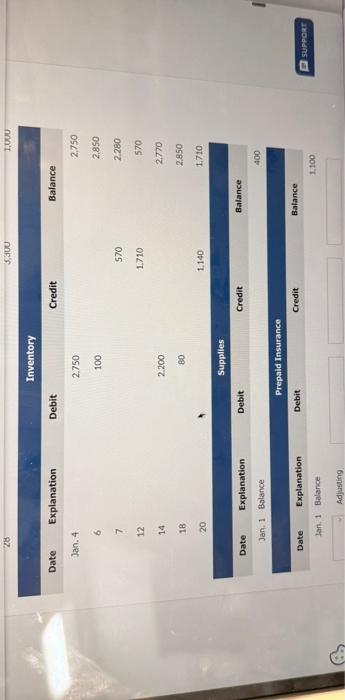

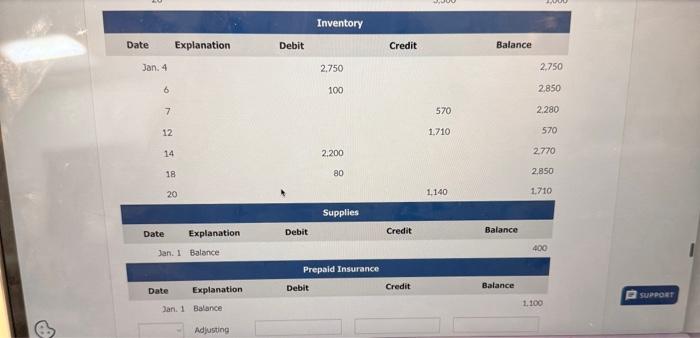

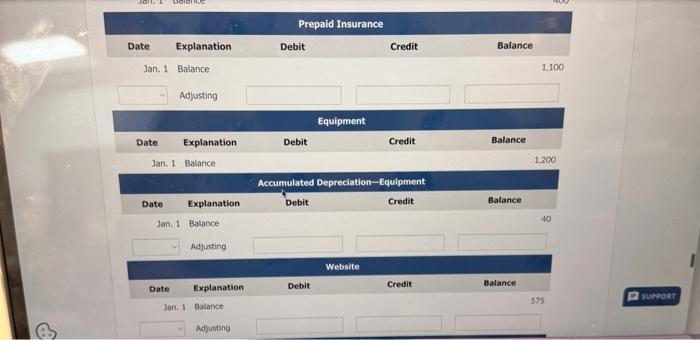

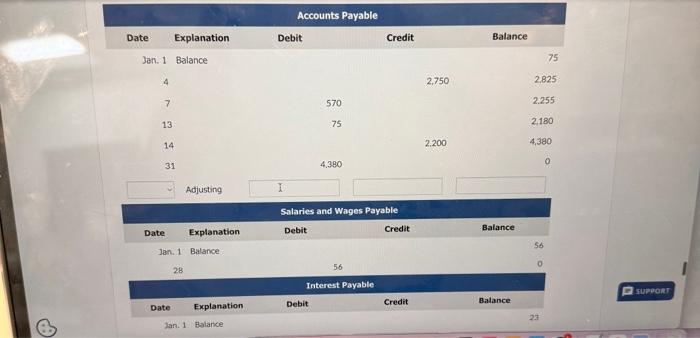

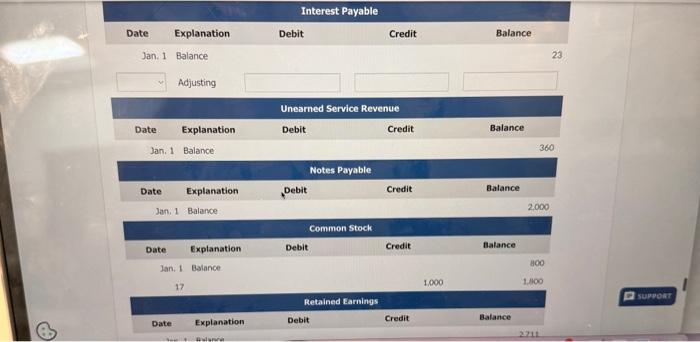

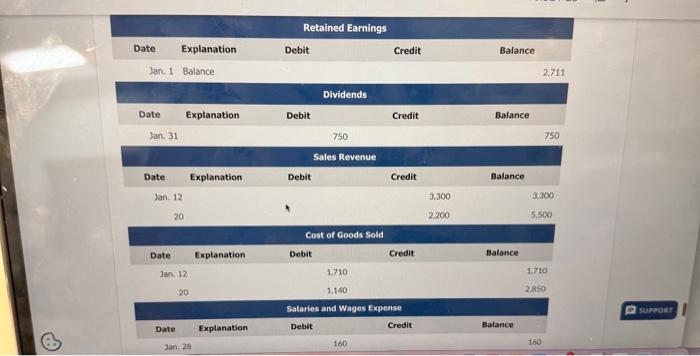

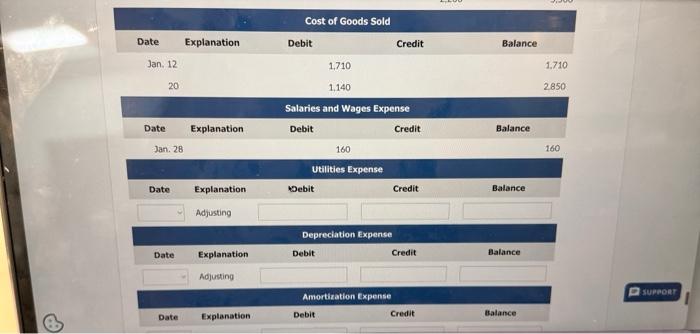

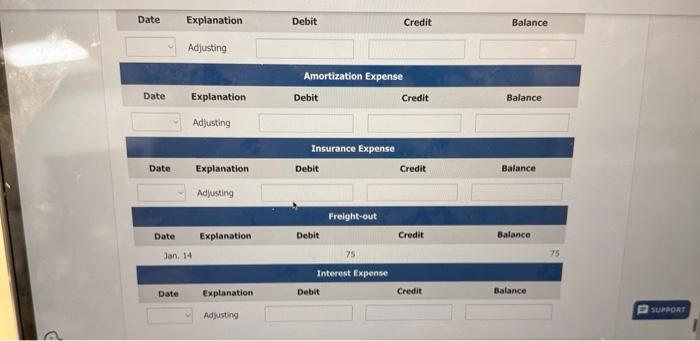

Because Natalie has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is to become the exclusive distributor of a line of fine European mixers. The current cost of a mixer is approximately $550, and Natalie would sell each one for \$1,100. Natalie comes to you for advice on how to account for these mixers. Each appliance has a serial number and can be easily identified. end, Natalie decides to use the perpetual method of accounting for inventory, and the following transactions happen during the month of Jamuary. Jan 4 She buys five deluxe mixers on account from Kzinski Supply Co, for $2,750, terms n/30. 6 She pays $100 freight on the January 4 purchase. 7 Natalie returns one of the mixers to Kzinski because it was damaged during shipping. Kzinski issues Cookle Creations credit for the cost of the mixer plus $20 for the cost of freight that was paid on January 6 for one mixer. 8 She collects $450 due from the neighborhood community center that was accrued at the end of December 2023. 12 She sells three deluxe mixers on account for $3,300,FOB destination, terms n/30. The mixers cost $570 each (incliding freight). 13. Natalie pays her cell phone bill previously accrued in the December adjusting journal entries. 14 She pays $75 of defivery charges for the three mikers that were sold on January 12. 14 She buys four deluxe mixers on account from Kzinsk Supply Ca. for $2.200, terms n/30 17 Natalie is concerned that there is not enough cash aval able to pay for all of the mixers purchased. She issues additional common stock for $1:000. 18. She pays Sao freight on the January 14 purchase. 14 She buys four deluxe mixers on account from Kzinski Supply Co. for $2,200, terms n/30. 17 Natalie is concerned that there is not enough cash available to pay for all of the mixers purchased. She issues additional common stock for $1,000. 18 She pays $80 frelght on the January 14 purchase, 20 She sells two deluxe mixers for $2,200 cash. 28 Natalie issues a check to her assistant. Her assistant worked 20 hours in January and is also paid for the amount accrued at December 31, 2023. Recall that Natalie's assistant earns $8 an hour. 28. Natalie collects amounts due from customers from the January 12 transaction. 31 She pays Kzinski all amounts due. 31 Cash dividends of $750 are paid. The post-closing trial balance from December is presented below. The post-closing trial balance from December is presented below. Ignore income tax effects. As of January 31 , the following adjusting entry data are awailable. 1. A count of brochures and posters reveals that none were used in January. 2. A count of baking supplies reveals that none were used in January 3. Another month's worth of depreciation needs to be recorded on the baking equipment bought in Nowember, (Recall that the baking equipment has a useful life of 5 years or 60 months and a 50 salvage value) 4. One month's worth of amortization needs to be reconded on the website. (Recall that the websitc has a useful life of 2 years or 24 months and a $0 salvage value, Its original cost was $600 ) 5. An additional month's worth of interest on her grandmother's loan needs to be accrued. (The interest rate is 9%.) 6. One month's worth of imsurance has expired. (Recall the 12 -month policy cost $1.200 ) 7. Natalie receives her cell phone bill \$75. The bill is for services provided in Jamuary and is due February 15. (Recall that the cell phone is used only for business purposes) 8. An analyis of the Unearned Reverue account reveals that Natalie has not had time to teach anv of these lessons this month because stre has been so busy selling mixers. As a result there is no change to the Uncarned Revenue account. Natalie hopes to schedule the outstanding lessors in February. 9. An inventocy coun of mixers as the end of January reveals that Natalie has three miners remainine. Post the adjusting journal entries required. suppoent suphent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts