Question: Please solve E4-9,E4-10 and E4-11 From book: Accounting Tools for Business (edition 6) E4-11 The unadjusted trial balance for Sierra Corp. is shown in Illustration

Please solve E4-9,E4-10 and E4-11 From book: Accounting Tools for Business (edition 6)

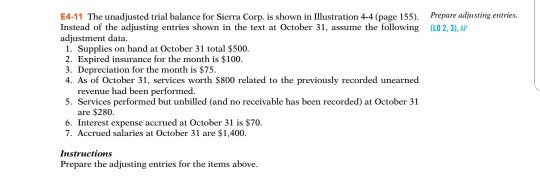

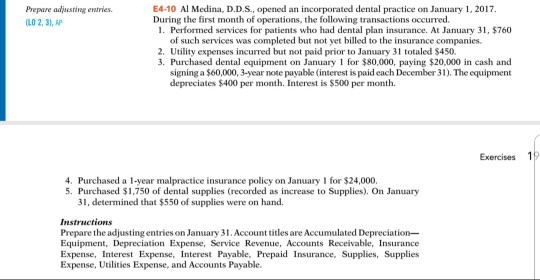

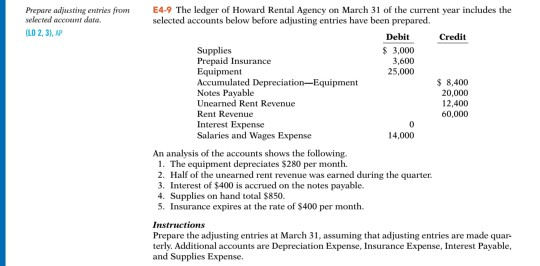

E4-11 The unadjusted trial balance for Sierra Corp. is shown in Illustration 4-4 (page 155). Prepre adusting entries Instead of the adjusting entries shown in the text at October 31, assume the following ILO 2, 3), AP adjustment data. adjusting entries 1. Supplies on hand at October 31 total $500. 2. Expired insurance for the month is $100. 3. Depreclation for the month is $75. 4. As of October 31, services worth $800 related to the previously recorded unearned revenue had been performed 5. Services performed but unbilled (and no receivable has been recorded) at October 31 are $280. 6. Interest expense accrued at October 31 is $70. 7. Accrued salaries at October 31 are $1,400. Instructions Prepare the adjusting entries for the items above. Prepare adjuesting eatries LO 2,3), AP E4-10 Al Medina, D.D.S., opened an incorporated dental practice on January 1, 2017. During the first month of operations, the following transactions occurred 1. Perforned services for patients who had dental plan insurance. At January 31, $760 of such services was completed but not yet billed to the insurance companies 2. Utility expenses incurred but not paid prior to January 31 totaled $450. 3. Purchased dental equipment on Jauary 1 for $80,000, paying $20,000 in cash and signing a $60,000, 3-year note payable (interest is paid each December 31). The equipment depreciates $400 per month. Interest is $500 per month Exercises 1 4. Purchased a 1-year malpractice insurance policy on January for $24,000. 5. Purchased $1,750 of dental supplies (recorded as increase to Supplies). On January 31, determined that $550 of supplies were on hand. Instructions Prepare the adjusting entries on January 31. Account titles are Accumulated Depreciation- Equipment, Depreciation Expense, Service Revenue, Accounts Receivable, Insurance Expense, Interst Expense, Interest Payable, Prepaid Insurance, Supplies, Supplies Expense, Utilities Expense, and Accounts Payable. Prepare adjusting entrieso selected accouet dara E4-9 The ledger of Howard Rental Agency on March 31 of the current year includes the selected accounts below before adjusting entries have been prepared. LO 2, 31, AP Debit Credit 3,000 3,600 25,000 Prepaid Insurance Notes Pavable Unearned Rent Revenue Rent Revenue Interest Expense Salaries and Wages Expense $ 8,400 20,000 12,400 60,000 4,000 An analysis of the accounts shows the following 1. The equipment depreciates $280 per month. 2. Half of the unearned rent revenue was earned during the quarter 3. Interest of $400 is accrued on the notes payable. 4. Supplies on hand total $850. 5. Insurance expires at the rate of $400 per month Prepare the adjusting entries at March 31, assuming that adjusting entries are made quar- terly. Additional accounts are Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts