Question: PLEASE SOLVE EACH ONE WITH WORKING DISPLAYED On October 1, Sarasota Ltd. purchased 8% bonds with a face value of $1,000 for trading purposes, accounting

PLEASE SOLVE EACH ONE WITH WORKING DISPLAYED

PLEASE SOLVE EACH ONE WITH WORKING DISPLAYED

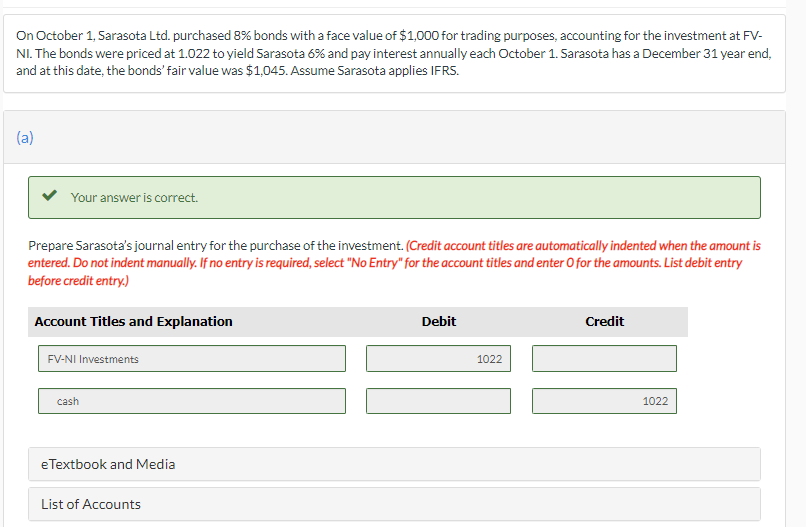

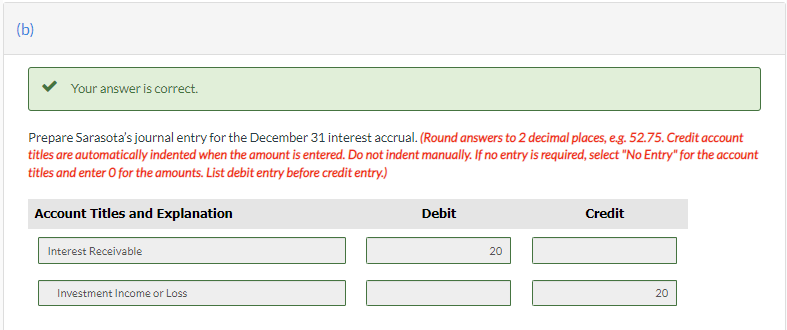

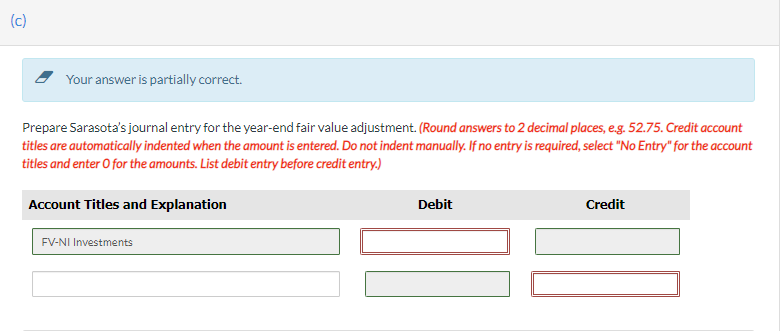

On October 1, Sarasota Ltd. purchased 8% bonds with a face value of $1,000 for trading purposes, accounting for the investment at FVNI. The bonds were priced at 1.022 to yield Sarasota 6% and pay interest annually each October 1 . Sarasota has a December 31 year end, and at this date, the bonds' fair value was $1,045. Assume Sarasota applies IFRS. (a) Prepare Sarasota's journal entry for the purchase of the investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Prepare Sarasota's journal entry for the December 31 interest accrual. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Your answer is partially correct. Prepare Sarasota's journal entry for the year-end fair value adjustment. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts