Question: Please solve each part. Thank you for the help! Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory

Please solve each part. Thank you for the help!

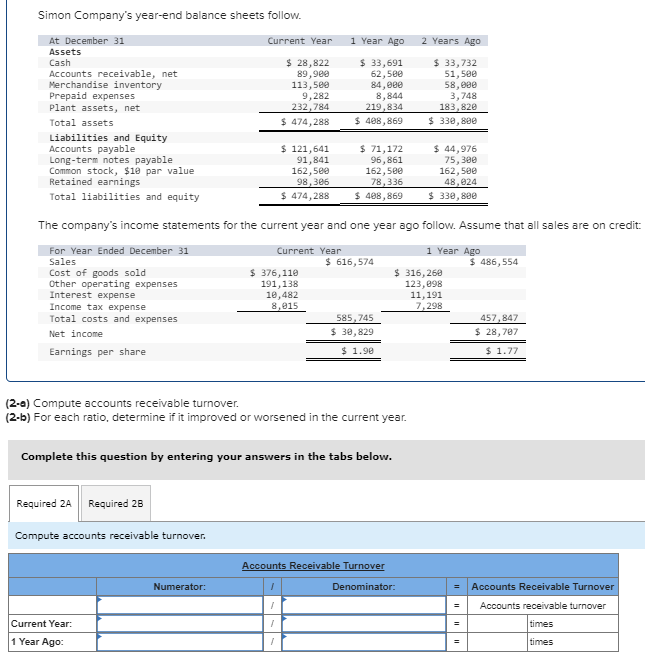

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Year Required 2A Required 28 Compute accounts receivable turnover. Current Year: 1 Year Ago: $ 28,822 89,900 113,500 9,282 232,784 $ 474,288 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: Current Year 1 Year Ago Numerator: $ 121,641 91,841 162,500 98,306 $ 474,288 $ 376,110 191,138 10,482 8,015 1 Year Ago $ 33,691 62,500 84,000 8,844 219,834 $ 408,869 $ 71,172 96,861 162,500 78,336 $ 408,869 1 1 1 1 (2-a) Compute accounts receivable turnover. (2-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. $ 616,574 585,745 $ 30,829 $ 1.90 2 Years Ago $ 33,732 51,500 58,000 3,748 183,820 $ 330,800 Accounts Receivable Turnover Denominator: $ 44,976 75,300 162,500 48,024 $ 330,800 $ 316,260 123,098 11,191 7,298 = = 11 = $ 486,554 457,847 $ 28,707 $ 1.77 Accounts Receivable Turnover Accounts receivable turnover times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts