Question: please solve each step in detail. explain with calculations and mention the formulas whereever its needed. Company X is considering to replace a steam separator

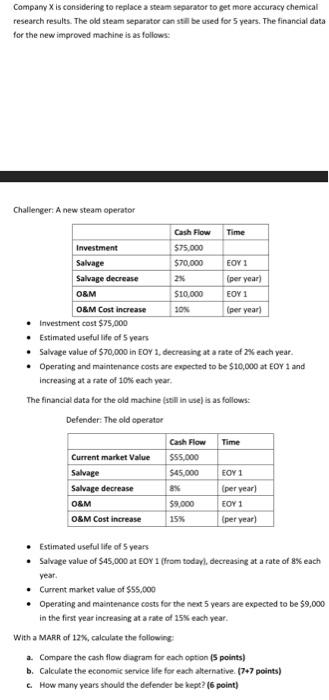

Company X is considering to replace a steam separator to get more accuracy chemical research results. The old steam seporator can still be used for 5 years. The financial data for the new improved machine is as follows: Challenger: A new steam operator - Investrnent cost $75,000 - Estimated useful life of 5 years - Salvage value of $70,000 in EOY 1, decreasinc at a rate of 2A each year. - Operating and maintenance costs are expected to be $10,000 at EOY 1 and increasing at a rate of 10os each year. The financial data for the old machine (atill in use) is as follows: Defender: The old operator - Estimated useful life of 5 years - Salvage value of $45,000 at EOr 1 (from todart, decreasing at a rate of 8% each year. - Current market value of $55,000 - Operating and maintenance costs for the next 5 years are expected to be $9,000 in the first year increasing at a rate of 15% each year. With a MARR of 12%, calculate the following: a. Compare the cash flow dagram for each option (s points) b. Calculate the economic service life for exch alternative. (7+7 points) c. How many years should the defender be kept? (6 point) Company X is considering to replace a steam separator to get more accuracy chemical research results. The old steam seporator can still be used for 5 years. The financial data for the new improved machine is as follows: Challenger: A new steam operator - Investrnent cost $75,000 - Estimated useful life of 5 years - Salvage value of $70,000 in EOY 1, decreasinc at a rate of 2A each year. - Operating and maintenance costs are expected to be $10,000 at EOY 1 and increasing at a rate of 10os each year. The financial data for the old machine (atill in use) is as follows: Defender: The old operator - Estimated useful life of 5 years - Salvage value of $45,000 at EOr 1 (from todart, decreasing at a rate of 8% each year. - Current market value of $55,000 - Operating and maintenance costs for the next 5 years are expected to be $9,000 in the first year increasing at a rate of 15% each year. With a MARR of 12%, calculate the following: a. Compare the cash flow dagram for each option (s points) b. Calculate the economic service life for exch alternative. (7+7 points) c. How many years should the defender be kept? (6 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts