Question: Please solve every question with work shown, especially question 3, thank you so much! The balance sheet and income statement shown below are for Koski

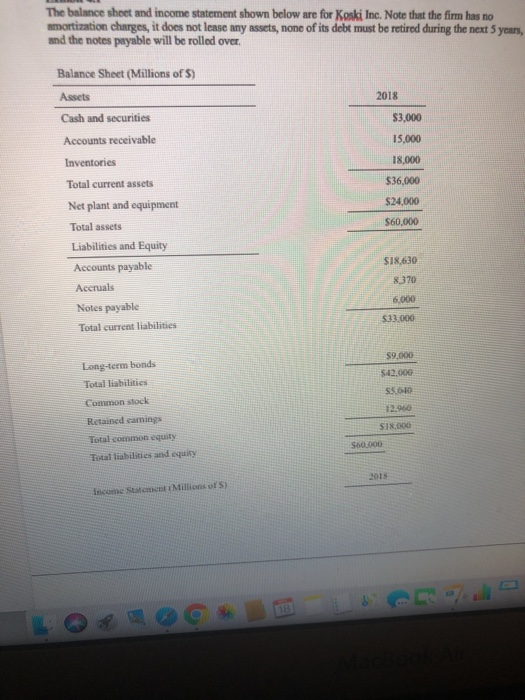

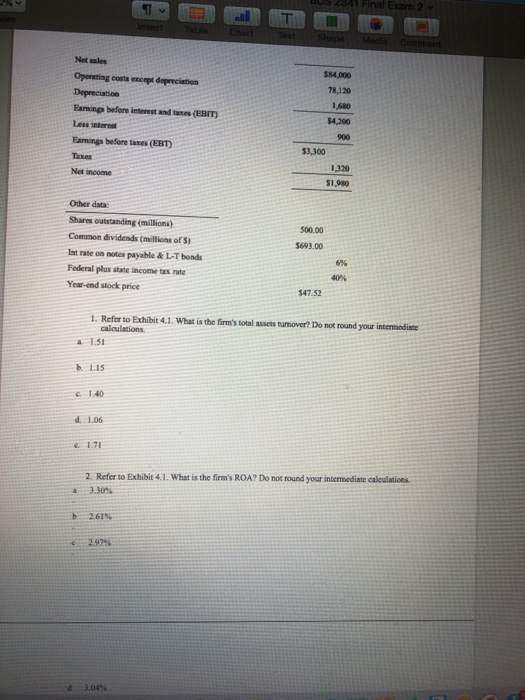

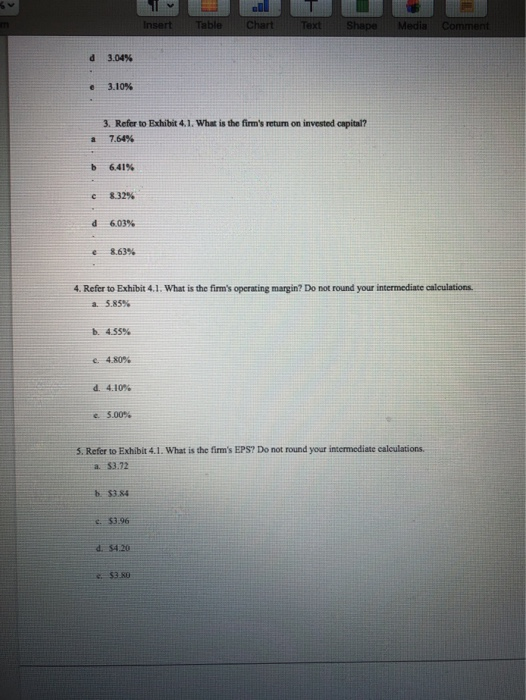

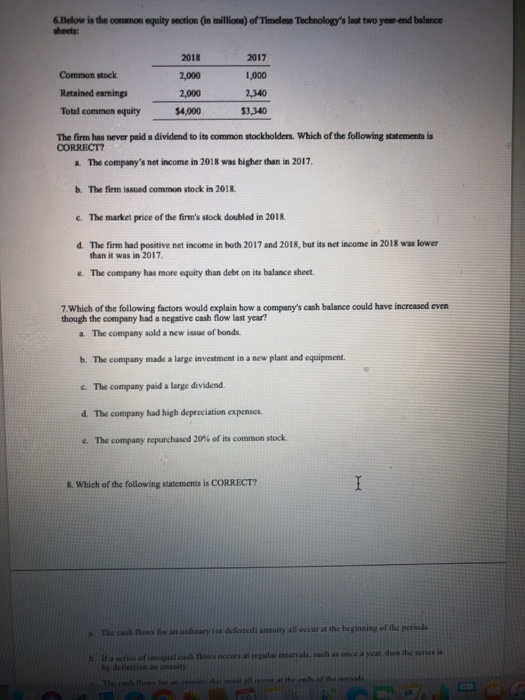

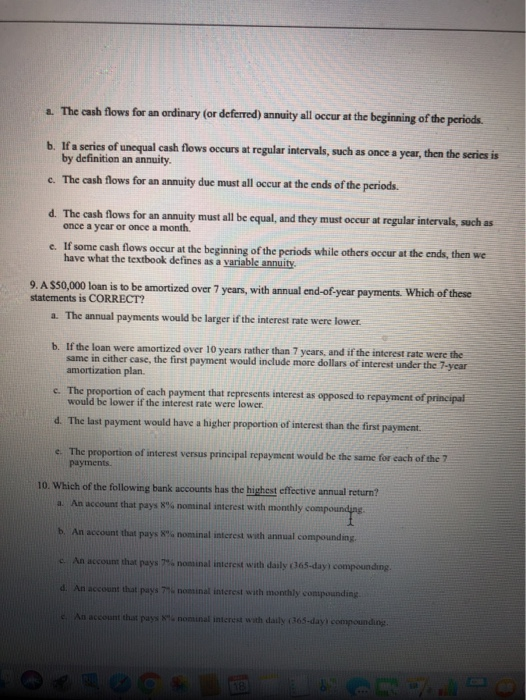

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. 2018 $3,000 15,000 18,000 $36,000 Balance Sheet (Millions of 5) Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities $24,000 $60,000 $18.630 8370 6.000 533.000 $9.000 Long-term bonds Total liabilities Common stock Retained camnings Total common equity Total liabilities and equity 5:42.000 SS OR 72.960 $18.000 S60.000 2015 Income Stat Millions of s) Final Exam 2 Net als Operating costs scept depreciation Depreciation Farming before interest and taxes (EBIT) Le Faming before taxes (EBT) 584,000 78,120 1.680 $4,200 900 33,300 1,320 $1,980 Net income Other data Share outstanding (millions) Common dividends (millions of 5) Intrate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price 500.00 $693.00 6% 401 547.52 1. Refer to Exhibit 4.1. What is the firm's total assets tumover? Do not round your intermediate calculations. a 1.51 b. L.IS d. 1.06 2. Refer to Exhibit 4.1. What is the firm's ROA? Do not found your intermediate calculations 3.30% a b 2.619 c 2.9794 d 3.045 Insert Table Chart Text Shape Media Comment d 3.04% 3.10% 3. Refer to Exhibit 4.1. What is the firm's retum on invested capital? 7.64% a b 6.41% c 8.32% d 6.03% 8.6394 4. Refer to Exhibit 4.1. What is the firm's operating margin? Do not round your intermediate calculations. a 5.85% b. 4.55% c. 4.80% d. 4.10% e. 5.00 5. Refer to Exhibit 4.1. What is the firm's EPS? Do not round your intermediate calculations a $3.72 $3.84 . 53:96 d. $4.20 S3.D 6.Below is the common equity section (in millions) of Timeless Technology's last two year-end balance sheet: 2018 Common stock 2,000 2,000 $4,000 2017 1,000 2,340 $3,340 Retained earnings Total common equity The firm has never paid a dividend to its common stockholders. Which of the following statements is CORRECT? . The company's net income in 2018 was higher than in 2017. b. The firm issued common stock in 2018. c. The market price of the firm's stock doubled in 2018. d. The firm had positive net income in both 2017 and 2018, but its net income in 2018 was lower than it was in 2017. e. The company has more equity than debt on its balance sheet. 7. Which of the following factors would explain how a company's cash balance could have increased even though the company had a negative cash flow last year? a. The company sold a new issue of bonds. b. The company made a large investment in a new plant and equipment. c. The company paid a large dividend. d. The company had high depreciation expenses e. The company repurchased 20% of its common stock 8. Which of the following statements is CORRECT? I The cash ows for an ordinary to deferred at all occur at the beginning of the periods If wees of equal cash flow our regular intervals such as orice a year, then the series is by definition an alty The fate the deather a. The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods. b. If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity c. The cash flows for an annuity due must all occur at the ends of the periods. d. The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month. c. If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity. 9. A $50,000 loan is to be amortized over 7 years, with annual end-of-year payments. Which of these statements is CORRECT? a. The annual payments would be larger if the interest rate were lower b. If the loan were amortized over 10 years rather than 7 years, and if the interest rate were the same in either case, the first payment would include more dollars of interest under the 7-year amortization plan. c. The proportion of each payment that represents interest as opposed to repayment of principal would be lower if the interest rate were lower d. The last payment would have a higher proportion of interest than the first payment. e. The proportion of interest versus principal repayment would be the same for each of the payments. 10. Which of the following bank accounts has the highest effective annual return? a. An account that pays 8" nominal interest with monthly compounding. b. An account that pays nominal interest with annual compounding, . An account that pays 7 nominal interest with daily (365-day compounding. d. An account that pays nominal interest with monthly compounding c. An account that pays nominal interes with daily (365-day compounding GE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts