Question: Please solve everything Duncan General Stores Inc. is authorized to issue $570,000 of 7.2%,10-year bonds. On December 31,2020 , when the market interest rate is

Please solve everything

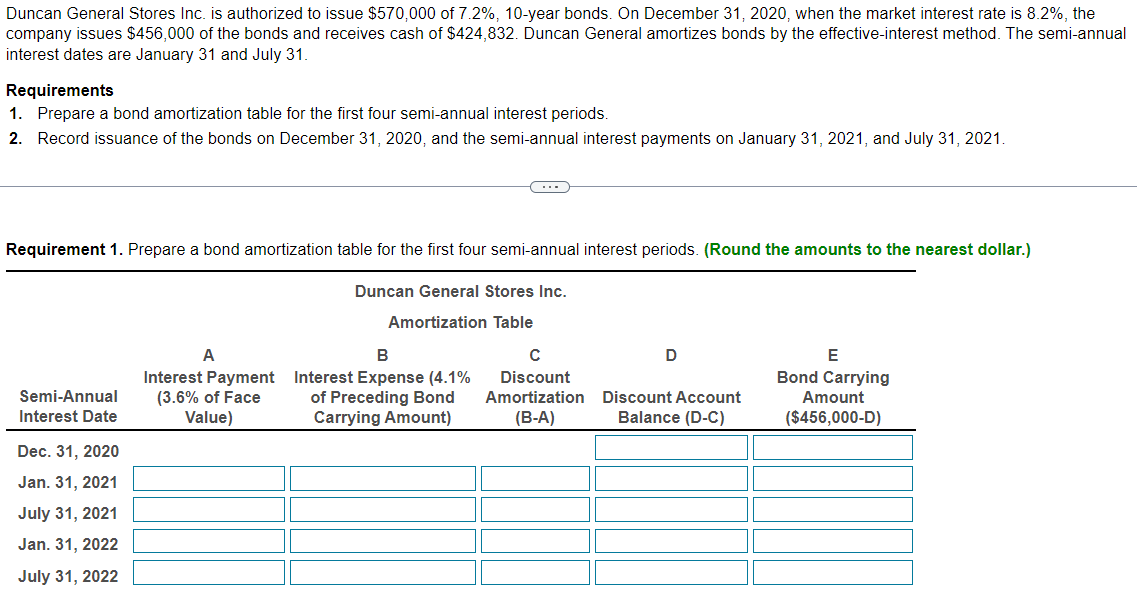

Duncan General Stores Inc. is authorized to issue $570,000 of 7.2%,10-year bonds. On December 31,2020 , when the market interest rate is 8.2%, the company issues $456,000 of the bonds and receives cash of $424,832. Duncan General amortizes bonds by the effective-interest method. The semi-annual interest dates are January 31 and July 31 . Requirements 1. Prepare a bond amortization table for the first four semi-annual interest periods. 2. Record issuance of the bonds on December 31,2020 , and the semi-annual interest payments on January 31,2021 , and July 31,2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts