Question: Please solve exercise 9.2. Exercise 9.1 is included for context. Thank you. Exercise 9.1 Consider the standard Black-Scholes model. Fix the time of maturity T

Please solve exercise 9.2. Exercise 9.1 is included for context. Thank you.

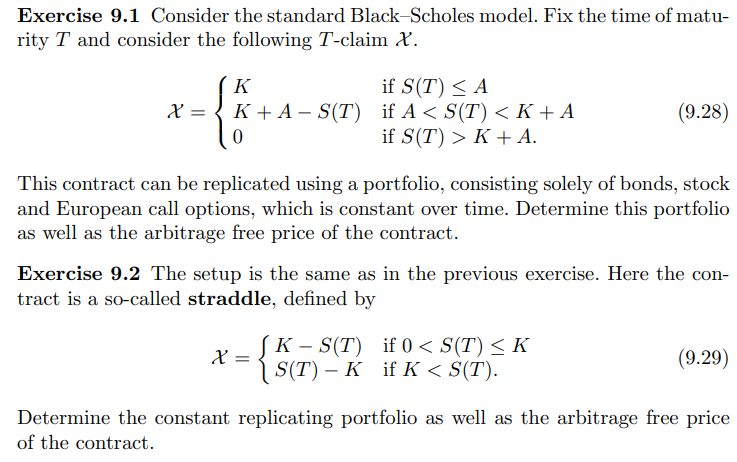

Exercise 9.1 Consider the standard Black-Scholes model. Fix the time of maturity T and consider the following T-claim X. X=KK+AS(T)0ifS(T)AifAK+A This contract can be replicated using a portfolio, consisting solely of bonds, stock and European call options, which is constant over time. Determine this portfolio as well as the arbitrage free price of the contract. Exercise 9.2 The setup is the same as in the previous exercise. Here the contract is a so-called straddle, defined by X={KS(T)S(T)Kif0K+A This contract can be replicated using a portfolio, consisting solely of bonds, stock and European call options, which is constant over time. Determine this portfolio as well as the arbitrage free price of the contract. Exercise 9.2 The setup is the same as in the previous exercise. Here the contract is a so-called straddle, defined by X={KS(T)S(T)Kif0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts