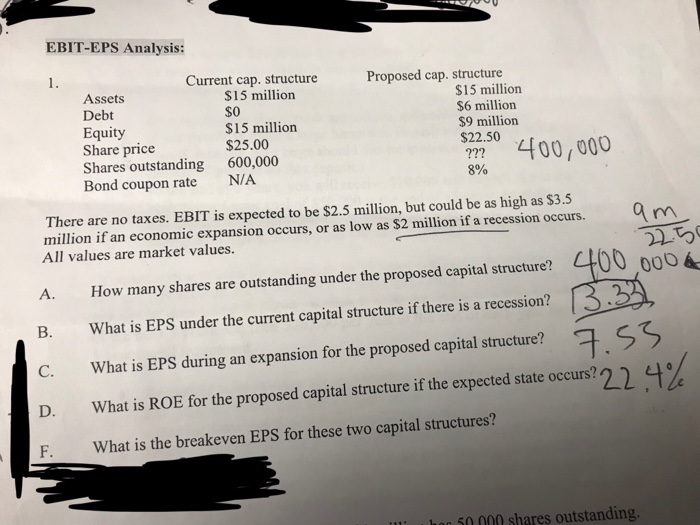

Question: Please solve F only and give a step by step explanation how you got to each point along the way. Thank you EBIT-EPS Analysis: Current

EBIT-EPS Analysis: Current cap. structure Proposed cap. structure Assets Debt Equity Share price Shares outstanding Bond coupon rate $15 million $0 $15 million $25.00 600,000 N/A $15 million $6 milliorn $9 million $22.50 00,000 8% There are no taxes. EBIT is expected to be $2.5 million, but could be as high as $3.5 million if an economic expansion occurs, or as low as $2 million if a recession occurs.m All values are market values. A. How many shares are outstanding under the proposed capital structure? 00 000 B. What is EPS under the current capital structure if there is a recession? C. What is EPS during an expansion for the proposed capital structure? D. What is ROE for the proposed capital structure if the expected state occurs? F. What is the breakeven EPS for these two capital structures? hog 50 000 shares outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts