Question: PLEASE SOLVE FAST AND USE THE SIMPLEST METHODS POSSIBLE AND SHOW STEPS IM 2ND YEAR ACCOUNTING COLLEGE. AND I DONT TAKE ADVANCED TECHNIQUES MY TEACHER

PLEASE SOLVE FAST AND USE THE SIMPLEST METHODS POSSIBLE AND SHOW STEPS IM 2ND YEAR ACCOUNTING COLLEGE. AND I DONT TAKE ADVANCED TECHNIQUES MY TEACHER WILL NOTICE PLEASE USE SIMPLE METHODS AND SHOW STEPS, THANK YOU

PLEASE SOLVE FAST AND USE THE SIMPLEST METHODS POSSIBLE AND SHOW STEPS IM 2ND YEAR ACCOUNTING COLLEGE. AND I DONT TAKE ADVANCED TECHNIQUES MY TEACHER WILL NOTICE PLEASE USE SIMPLE METHODS AND SHOW STEPS, THANK YOU

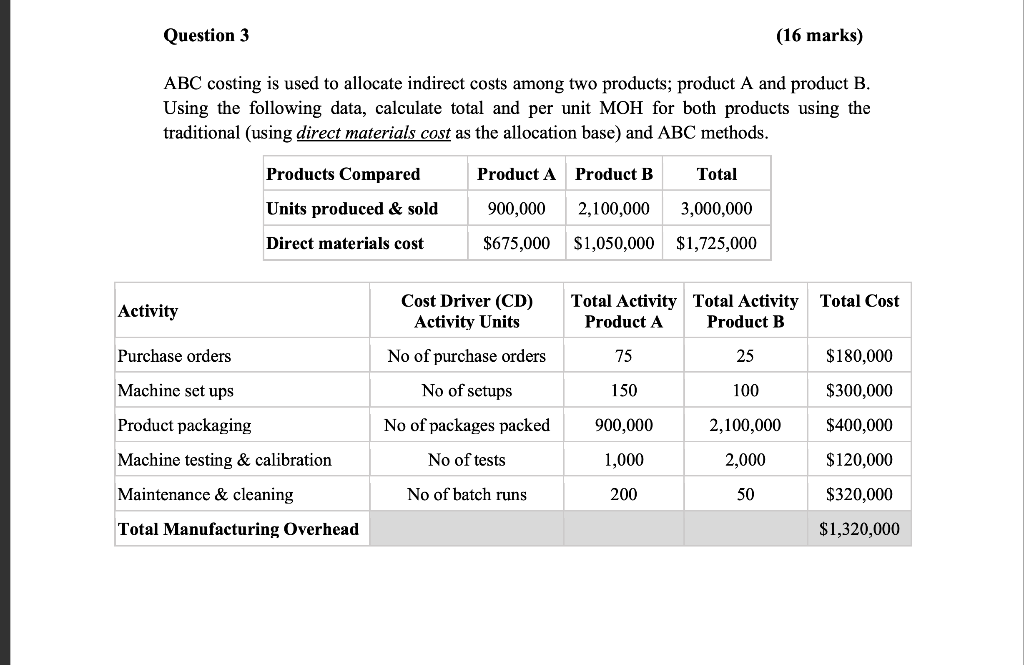

Question 3 (16 marks) ABC costing is used to allocate indirect costs among two products; product A and product B. Using the following data, calculate total and per unit MOH for both products using the traditional (using direct materials cost as the allocation base) and ABC methods. Products Compared Product A Product B Total Units produced & sold 900,000 2,100,000 3,000,000 Direct materials cost $675,000 $1,050,000 $1,725,000 Total Cost Activity Cost Driver (CD) Activity Units Total Activity Total Activity Product A Product B Purchase orders No of purchase orders 75 25 $180,000 Machine set ups No of setups 150 100 $300,000 Product packaging No of packages packed 900,000 2,100,000 $400,000 Machine testing & calibration No of tests 1,000 2,000 $120,000 Maintenance & cleaning No of batch runs 200 50 $320,000 Total Manufacturing Overhead $1,320,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts