Question: Please solve (financial calculus - black scholes model): Please don't solve if unsure (DONT USE CHATGPT - will downvote) Consider a stock (without dividends) whose

Please solve (financial calculus - black scholes model):

Please don't solve if unsure (DONT USE CHATGPT - will downvote)

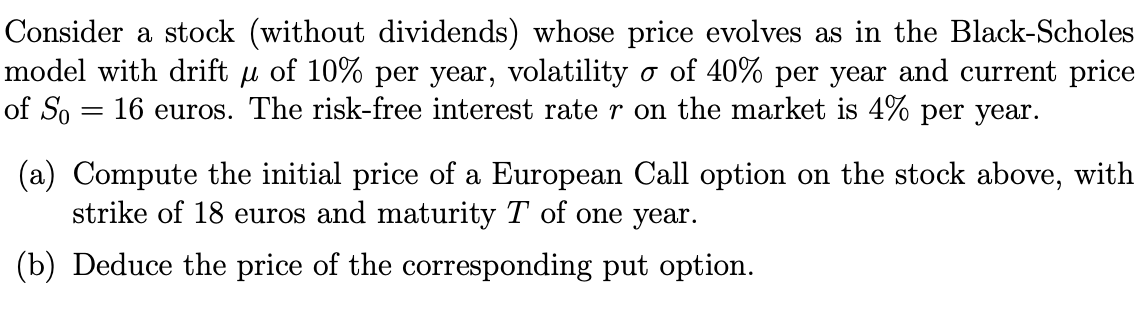

Consider a stock (without dividends) whose price evolves as in the Black-Scholes model with drift of 10% per year, volatility of 40% per year and current price of S0=16 euros. The risk-free interest rate r on the market is 4% per year. (a) Compute the initial price of a European Call option on the stock above, with strike of 18 euros and maturity T of one year. (b) Deduce the price of the corresponding put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts