Question: Please solve for : 1. Viable manufacturing overhead (%) in the YELLOW BOX 2. Flexible Budget Variance Direct manufacturing labor use Variable manufacturing overhead 0.02

Please solve for :

1. Viable manufacturing overhead (%) in the YELLOW BOX

2. Flexible Budget Variance

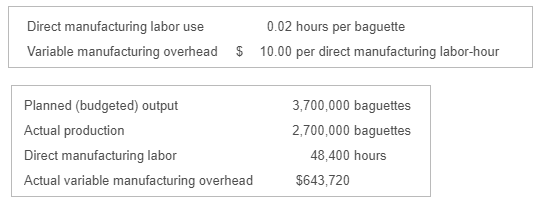

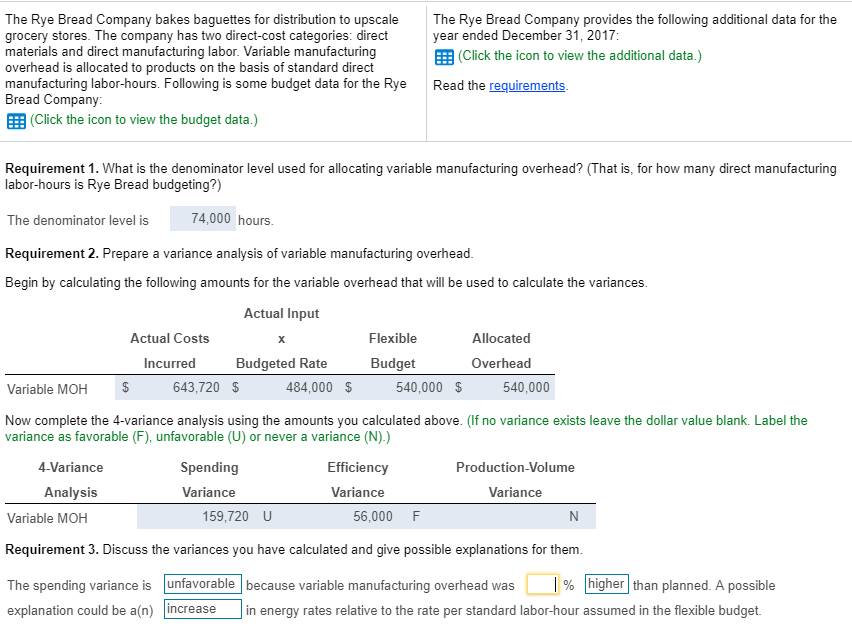

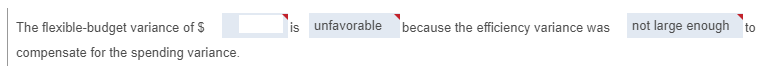

Direct manufacturing labor use Variable manufacturing overhead 0.02 hours per baguette 10.00 per direct manufacturing labor-hour Planned (budgeted) output Actual production Direct manufacturing labor Actual variable manufacturing overhead 3,700,000 baguettes 2,700,000 baguettes 48.400 hours $643,720 The Rye Bread Company bakes baguettes for distribution to upscaleThe Rye Bread Company provides the following additional data for the grocery stores. The company has two direct-cost categories: direct materials and direct manufacturing labor. Variable manufacturing overhead is allocated to products on the basis of standard direct manufacturing labor-hours. Following is some budget data for the Rye Read the requirements Bread Company: EEB (Click the icon to view the budget data.) year ended December 31, 2017 EEB (Click the icon to view the additional data.) Requirement 1. What is the denominator level used for allocating variable manufacturing overhead? (That is, for how many direct manufacturing abor-hours is Rye Bread budgeting?) The denominator level is Requirement 2. Prepare a variance analysis of variable manufacturing overhead Begin by calculating the following amounts for the variable overhead that will be used to calculate the variances 74,000 hours Actual Input Actual Costs Flexible Allocated Incurred Budgeted Rate Budget Overhead Variable MOH 643,720 $ 484,000 $ 540,000 $ 540,000 Now complete the 4-variance analysis using the amounts you calculated above. (If no variance exists leave the dollar value blank. Label the variance as favorable (F), unfavorable (U) or never a variance (N).) 4-Variance Spending Efficiency Production-Volum Analysis Variance Variance Variance 159,720 U 56,000 F Variable MOH Requirement 3. Discuss the variances you have calculated and give possible explanations for them The spending variance is unfavorable because variable manufacturing overhead was explanation could be a(n) increase energy rates relative to the rate per standard labor-hour assumed in the flexible budget. % higher than planned. A possible The flexible-budget variance of is unfavorable because the efficiency variance was not large enough to compensate for the spending variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts