Question: Please solve for A and B. Please show your work. Please explain your reasoning. Your firm is planning to purchase 50,000 barrels of oil on

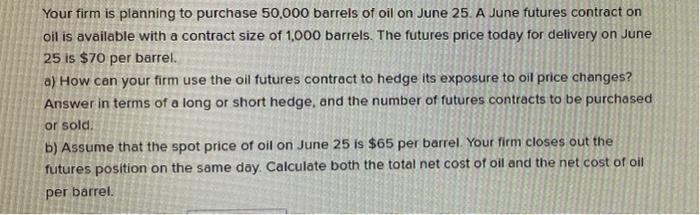

Your firm is planning to purchase 50,000 barrels of oil on June 25. A June futures contract on oil is available with a contract size of 1,000 barrels. The futures price today for delivery on June 25 is $70 per barrel. a) How can your firm use the oil futures contract to hedge its exposure to oil price changes? Answer in terms of a long or short hedge, and the number of futures contracts to be purchased or sold. b) Assume that the spot price of oil on June 25 is $65 per barrel. Your firm closes out the futures position on the same day. Calculate both the total net cost of oil and the net cost of oil per barrel. Your firm is planning to purchase 50,000 barrels of oil on June 25. A June futures contract on oil is available with a contract size of 1,000 barrels. The futures price today for delivery on June 25 is $70 per barrel. a) How can your firm use the oil futures contract to hedge its exposure to oil price changes? Answer in terms of a long or short hedge, and the number of futures contracts to be purchased or sold. b) Assume that the spot price of oil on June 25 is $65 per barrel. Your firm closes out the futures position on the same day. Calculate both the total net cost of oil and the net cost of oil per barrel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts