Question: Please solve for A, B, and C. Please show your work. Please explain your reasoning. Consider an American put option on a non-dividend-paying stock. Other

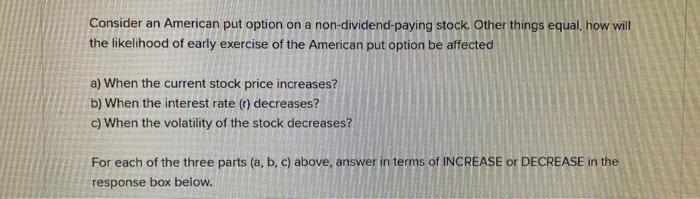

Consider an American put option on a non-dividend-paying stock. Other things equal, how will the likelihood of early exercise of the American put option be affected a) When the current stock price increases? b) When the interest rate (1) decreases? c) When the volatility of the stock decreases? For each of the three parts (a, b, c) above, answer in terms of INCREASE or DECREASE in the response box below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts