Question: Please solve for A, B, and C. Please show your work. Please explain your reasoning. A copper producer plans to sell 150,000 pounds of copper

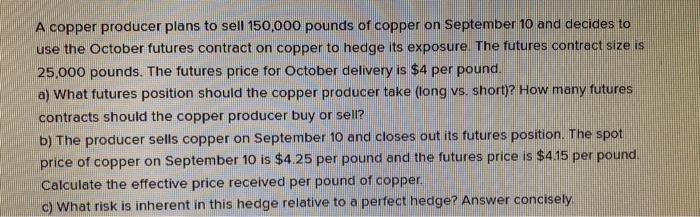

A copper producer plans to sell 150,000 pounds of copper on September 10 and decides to use the October futures contract on copper to hedge its exposure. The futures contract size is 25,000 pounds. The futures price for October delivery is $4 per pound. a) What futures position should the copper producer take (long vs. short)? How many futures contracts should the copper producer buy or sell? b) The producer sells copper on September 10 and closes out its futures position. The spot price of copper on September 10 is $4 25 per pound and the futures price is $4.15 per pound Calculate the effective price received per pound of copper c) What risk is inherent in this hedge relative to a perfect hedge? Answer concisely

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts