Question: Please solve for A, B, and C. Please show your work. Please explain your reasoning. You own 10,000 shares of a stock whose price is

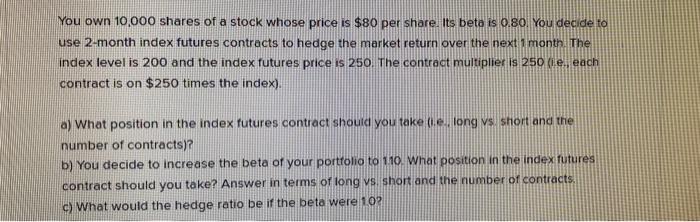

You own 10,000 shares of a stock whose price is $80 per share. Its beta is 0.80. You decide to use 2-month index futures contracts to hedge the market return over the next 1 month. The index level is 200 and the index futures price is 250. The contract multiplier is 250 (ie. each contract is on $250 times the index). a) What position in the index futures contract should you take e., long vs short and the number of contracts)? b) You decide to increase the beta of your portfolio to 110. What position in the index futures contract should you take? Answer in terms of long vs. short and the number of contracts. c) What would the hedge ratio be if the beta were 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts