Question: please solve for A Consider Commodity Z, which has both exchange-traded futures and option contracts associated with it. As you look in today's paper, you

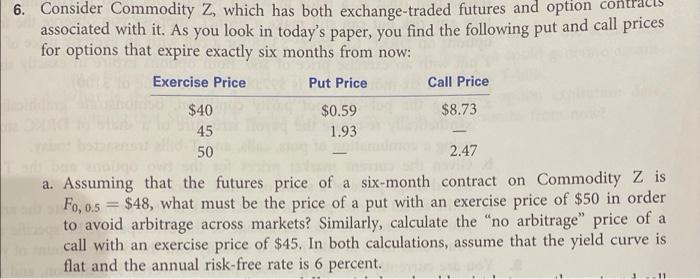

Consider Commodity Z, which has both exchange-traded futures and option contracts associated with it. As you look in today's paper, you find the following put and call prices for options that expire exactly six months from now: a. Assuming that the futures price of a six-month contract on Commodity Z is F0,0.5=$48, what must be the price of a put with an exercise price of $50 in order to avoid arbitrage across markets? Similarly, calculate the "no arbitrage" price of a call with an exercise price of $45. In both calculations, assume that the yield curve is flat and the annual risk-free rate is 6 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts