Question: please solve for all A B and C. Thanks! The terms of the lease and of the purchase are os tilget. year 3 undee the

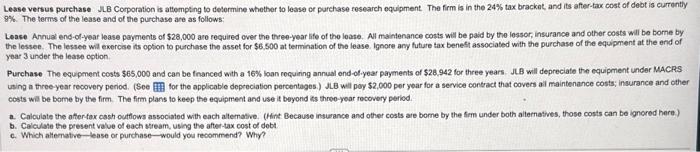

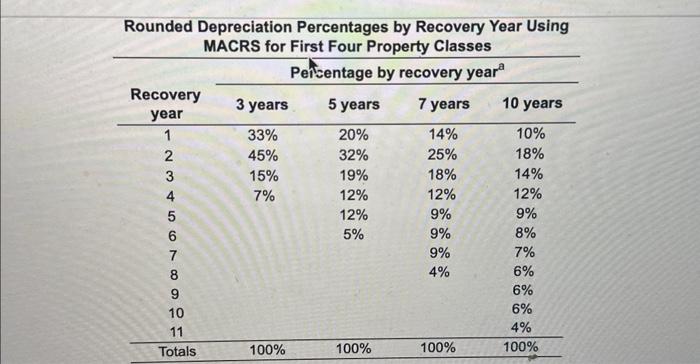

The terms of the lease and of the purchase are os tilget. year 3 undee the lease option. con's wel be tome by the fim. The frm pluas to keep the equipment and ube in beyond as three year recover period. c. Which altemative lease of purchuse-would you recempens? Why? 2. The atettax cash ovitow asvopiared whthe leave in year t is t (Poond to the nearesi dolar) Lease versus purchase JLB Corporation is attompting to determine whether to lease or purchase research oquipment. The firm is in the 24% tax brackot, and its atter-tax cost of debt is curtontiy 8\%. The terms of the lease and of the purchase are as follows: Leace Annual end-of-year lease payments of $28,000 aro required over the thre0-year life of the loase. Al maintenance costs will be paid by the lessor, insurance and other costs wil be borne by the lessee. The lessee wil exercse its opton to purchase the asset for $6.500 at temination of the lease. lgnore any futare tax benest associated with the purchase of the equipment at the end of year 3 under the lease option. Purchase The equipment costs $65,000 and can be fnanced with a 16% loan roquinng annual end-of-year payments of $28,942 for three years. JLB will depreciate the equipment under MACRS using a three-year recovery period. (See for the applicable depreciation percentages.) JLB will poy $2,000 per year for a service contract that covers al maintenance costs; insurance and other costs wis be bome by the firm. The firm plans to keep the equipment and use it beyond ts thro--year rocovery period. a. Calculate the after tox cash outflows associated with each altemative. (Hint Because insurance and other costs are bome by the fim under both alternatives, those costs can be ignored here.) b. Caiculate the present value of each stream, using the after-tax cost of debt. c. Which alfematve lease or purchase - would you recommend? Why? Rounded Depreciation Percentages by Recovery Year Using MAPDE fan Eiret Eaur Dranathi Clacene The terms of the lease and of the purchase are os tilget. year 3 undee the lease option. con's wel be tome by the fim. The frm pluas to keep the equipment and ube in beyond as three year recover period. c. Which altemative lease of purchuse-would you recempens? Why? 2. The atettax cash ovitow asvopiared whthe leave in year t is t (Poond to the nearesi dolar) Lease versus purchase JLB Corporation is attompting to determine whether to lease or purchase research oquipment. The firm is in the 24% tax brackot, and its atter-tax cost of debt is curtontiy 8\%. The terms of the lease and of the purchase are as follows: Leace Annual end-of-year lease payments of $28,000 aro required over the thre0-year life of the loase. Al maintenance costs will be paid by the lessor, insurance and other costs wil be borne by the lessee. The lessee wil exercse its opton to purchase the asset for $6.500 at temination of the lease. lgnore any futare tax benest associated with the purchase of the equipment at the end of year 3 under the lease option. Purchase The equipment costs $65,000 and can be fnanced with a 16% loan roquinng annual end-of-year payments of $28,942 for three years. JLB will depreciate the equipment under MACRS using a three-year recovery period. (See for the applicable depreciation percentages.) JLB will poy $2,000 per year for a service contract that covers al maintenance costs; insurance and other costs wis be bome by the firm. The firm plans to keep the equipment and use it beyond ts thro--year rocovery period. a. Calculate the after tox cash outflows associated with each altemative. (Hint Because insurance and other costs are bome by the fim under both alternatives, those costs can be ignored here.) b. Caiculate the present value of each stream, using the after-tax cost of debt. c. Which alfematve lease or purchase - would you recommend? Why? Rounded Depreciation Percentages by Recovery Year Using MAPDE fan Eiret Eaur Dranathi Clacene

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts