Question: Please solve for all asap!! Thx !!:)) All info needed is on the question. Please answer soon! thx:)) EPS and postmerger price Data for Henry

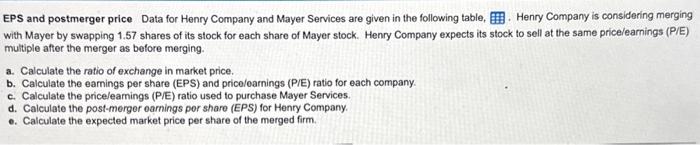

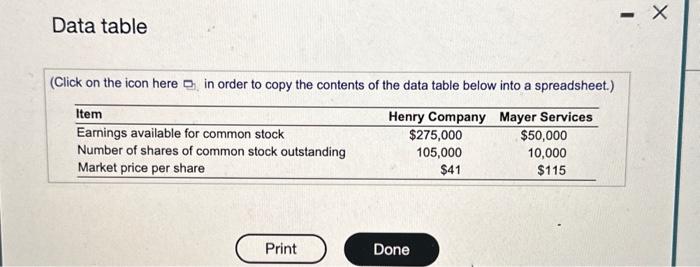

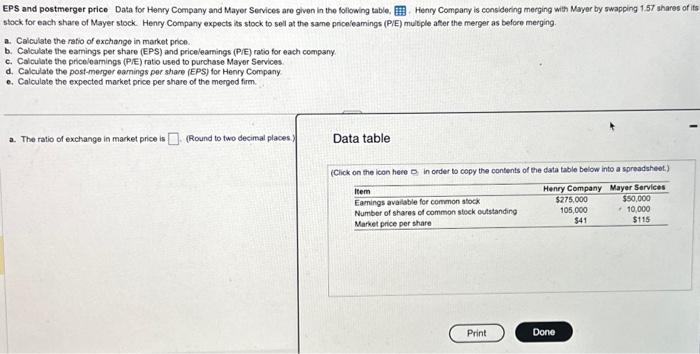

EPS and postmerger price Data for Henry Company and Mayer Services are given in the following table, . Henry Company is considering merging with Mayer by swapping 1.57 shares of its stock for each share of Mayer stock. Henry Company expects its stock to sell at the same price/earnings (P/E) multiple after the merger as before merging. a. Calculate the ratio of exchange in market price. b. Calculate the earnings per share (EPS) and pricoloarnings (P/E) ratio for each company. c. Calculate the pricelearnings (P/E) ratio used to purchase Mayer Services. d. Calculate the post-merger oamings por share (EPS) for Henry Company. e. Calculate the expected market price per share of the merged firm. Data table (Click on the icon here , in order to copy the contents of the data table below into a spreadsheet.) EPS and postmerger price Data for Herry Company and Mayer Services are given in the following table. Henry Compary is considering merging with Mayer by swapping 1.57 shares of its stock for each share of Mayer stock. Henry Company expects is stock to sell at the sane priceieamings (PIE) multile atter the merger as before merging. a. Calculate the rafio of exchange in markot price. b. Calculate the eamings per share (EPS) and priceleamings (P/E) ratio for each company. c. Calculate the pricoloamings (PIE) ratio used to purchase Mayor Services. d. Calculate the post-merger eamings per share (EPS) for Henry Company e. Calculate the expected market price per share of the merged firm. a. The ratio of exchange in market price is (Round to two decimal places: ) Data table (Cick on the icon here D in order to copy the contents of tere data table beiow into a spreadsheot.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts