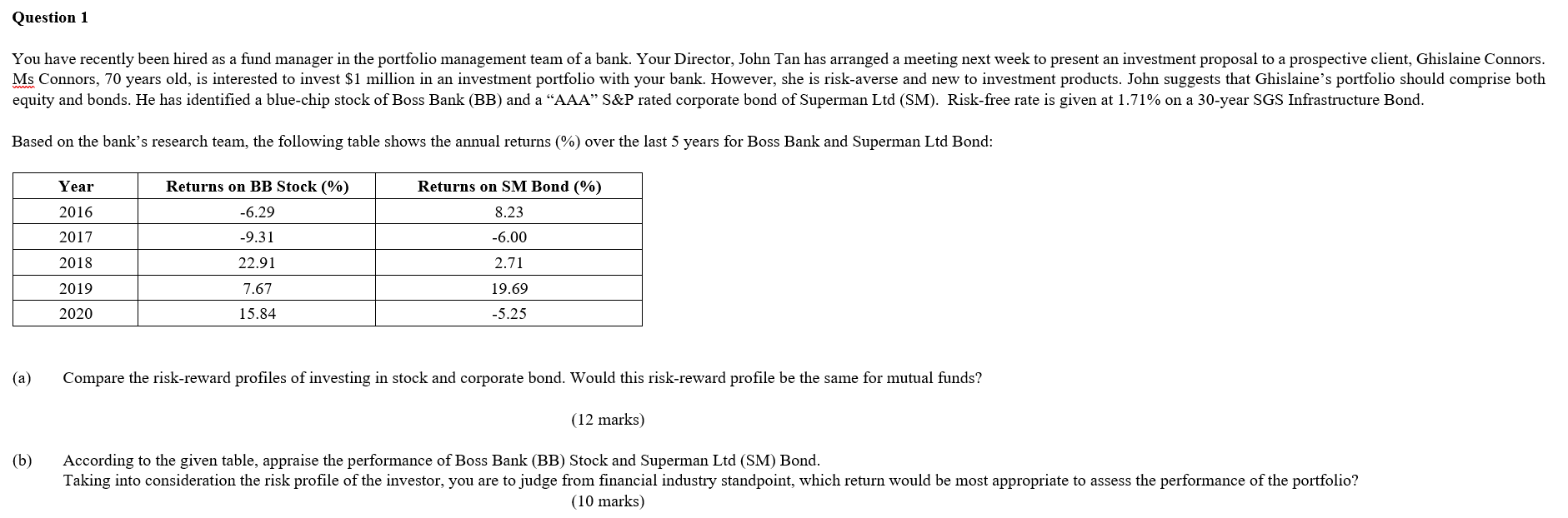

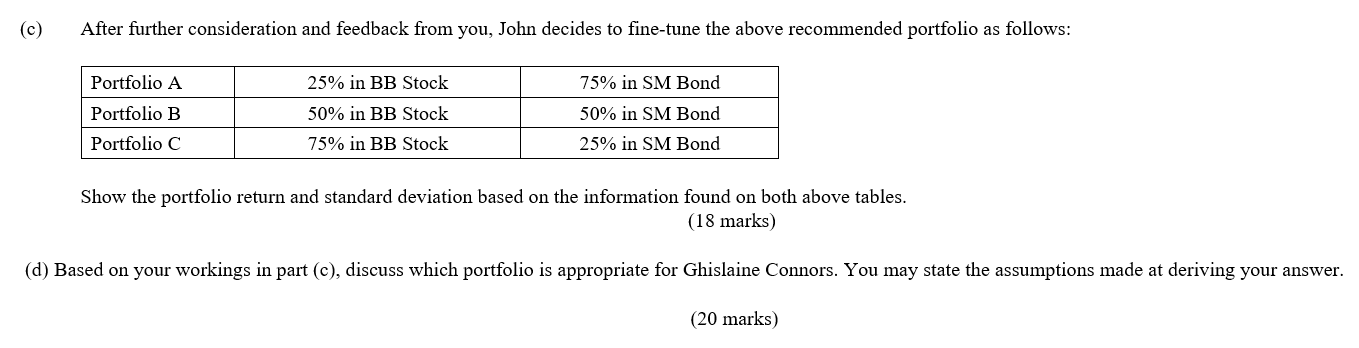

Question: Please solve for all parts. For part (c), solve using the attached formula sheet. Show relevant workings. Question 1 You have recently been hired as

Please solve for all parts.

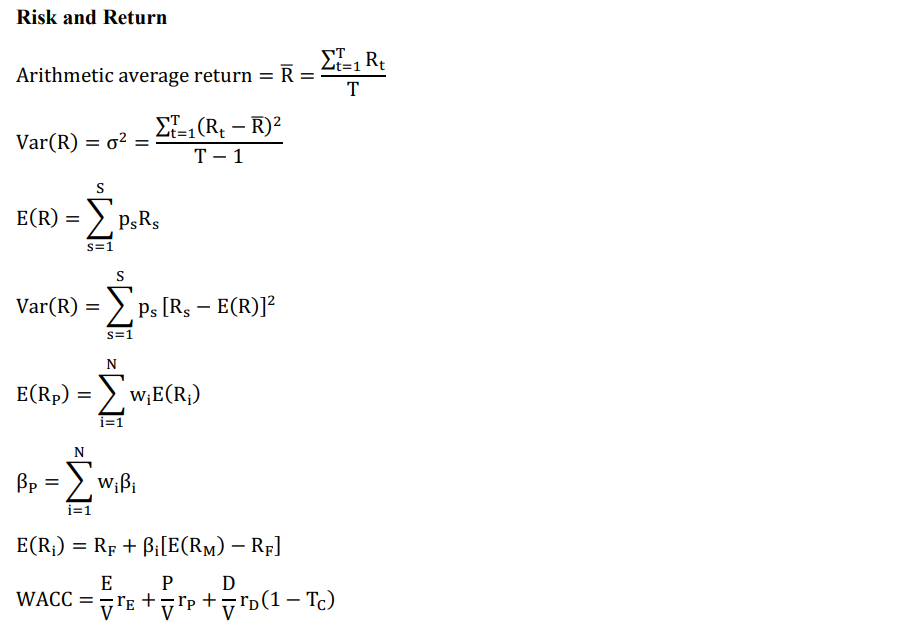

For part (c), solve using the attached formula sheet. Show relevant workings.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts