Question: Please solve for all! Thx!! :) DFL and graphical display of financing plans Wells and Associates has EBIT of $69,600. Interest costs are $20,800, and

Please solve for all! Thx!! :)

Please solve for all! Thx!! :)

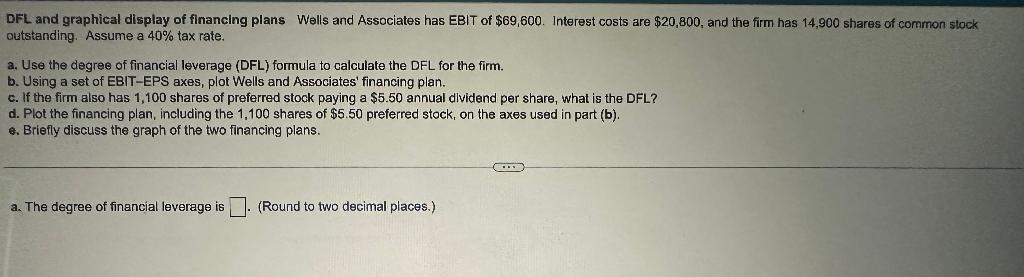

DFL and graphical display of financing plans Wells and Associates has EBIT of $69,600. Interest costs are $20,800, and the firm has 14,900 shares of coramon stock outstanding. Assume a 40% tax rate. a. Use the degree of financial leverage (DFL) formula to calculate the DFL for the firm. b. Using a set of EBIT-EPS axes, plot Wells and Associates' financing plan. c. If the firm also has 1,100 shares of preferred stock paying a $5.50 annual dlvidend per share, what is the DFL? d. Plot the financing plan, including the 1,100 shares of $5.50 preferred stock, on the axes used in part (b). 6. Briefly discuss the graph of the two financing plans. a. The degree of financial leverage is (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts