Question: please solve for me these five questions Problem 1: The Walton Electric is a big success. The company wants to start a new project of

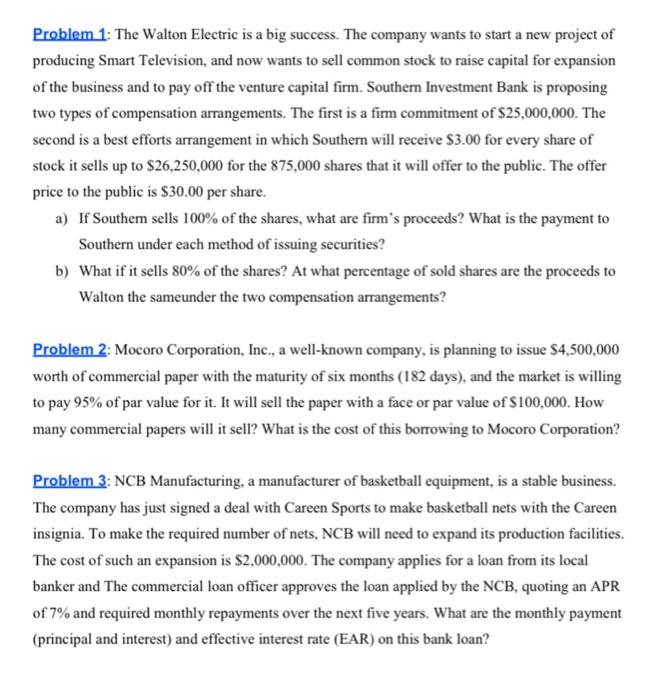

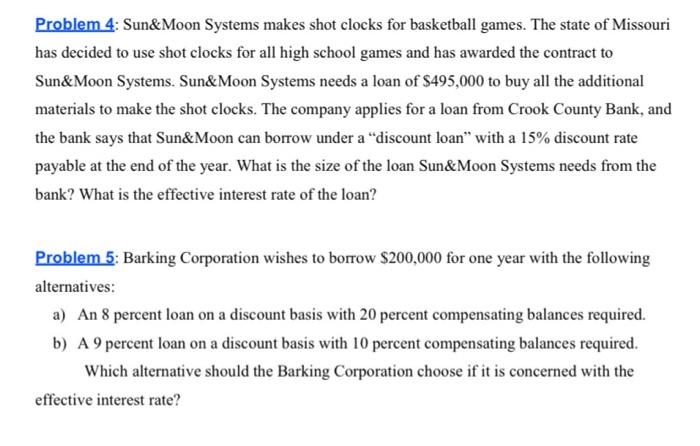

Problem 1: The Walton Electric is a big success. The company wants to start a new project of producing Smart Television, and now wants to sell common stock to raise capital for expansion of the business and to pay off the venture capital firm. Southern Investment Bank is proposing two types of compensation arrangements. The first is a fimm commitment of $25,000,000. The second is a best efforts arrangement in which Southern will receive $3.00 for every share of stock it sells up to $26,250,000 for the 875,000 shares that it will offer to the public. The offer price to the public is $30.00 per share. a) If Southern sells 100% of the shares, what are firm's proceeds? What is the payment to Southern under each method of issuing securities? b) What if it sells 80% of the shares? At what percentage of sold shares are the proceeds to Walton the sameunder the two compensation arrangements? Problem 2: Mocoro Corporation, Inc., a well-known company, is planning to issue $4,500,000 worth of commercial paper with the maturity of six months (182 days), and the market is willing to pay 95% of par value for it. It will sell the paper with a face or par value of $100,000. How many commercial papers will it sell? What is the cost of this borrowing to Mocoro Corporation? Problem 3: NCB Manufacturing, a manufacturer of basketball equipment, is a stable business. The company has just signed a deal with Careen Sports to make basketball nets with the Careen insignia. To make the required number of nets, NCB will need to expand its production facilities. The cost of such an expansion is $2,000,000. The company applies for a loan from its local banker and The commercial loan officer approves the loan applied by the NCB, quoting an APR of 7% and required monthly repayments over the next five years. What are the monthly payment (principal and interest) and effective interest rate (EAR) on this bank loan? Problem 4: Sun&Moon Systems makes shot clocks for basketball games. The state of Missouri has decided to use shot clocks for all high school games and has awarded the contract to Sun&Moon Systems. Sun&Moon Systems needs a loan of $495,000 to buy all the additional materials to make the shot clocks. The company applies for a loan from Crook County Bank, and the bank says that Sun&Moon can borrow under a "discount loan" with a 15% discount rate payable at the end of the year. What is the size of the loan Sun&Moon Systems needs from the bank? What is the effective interest rate of the loan? Problem 5: Barking Corporation wishes to borrow $200,000 for one year with the following alternatives: a) An 8 percent loan on a discount basis with 20 percent compensating balances required. b) A 9 percent loan on a discount basis with 10 percent compensating balances required. Which alternative should the Barking Corporation choose if it is concerned with the effective interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts