Question: Please solve for question 2. I have also attached question 1 as you would need some information from that question. Please solve for all the

Please solve for question 2. I have also attached question 1 as you would need some information from that question. Please solve for all the parts of question 2. I will give you a thumbs up.

Please solve for question 2. I have also attached question 1 as you would need some information from that question. Please solve for all the parts of question 2. I will give you a thumbs up.

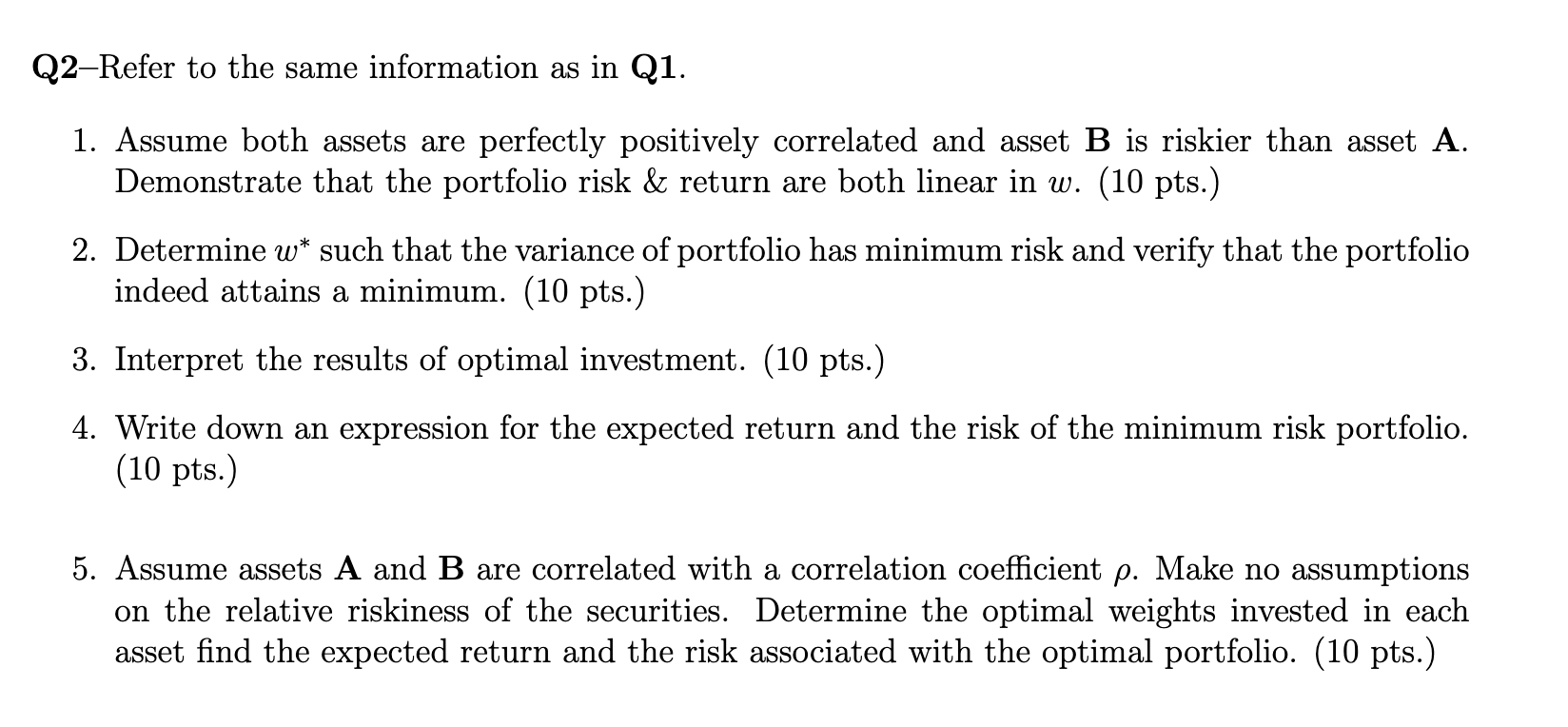

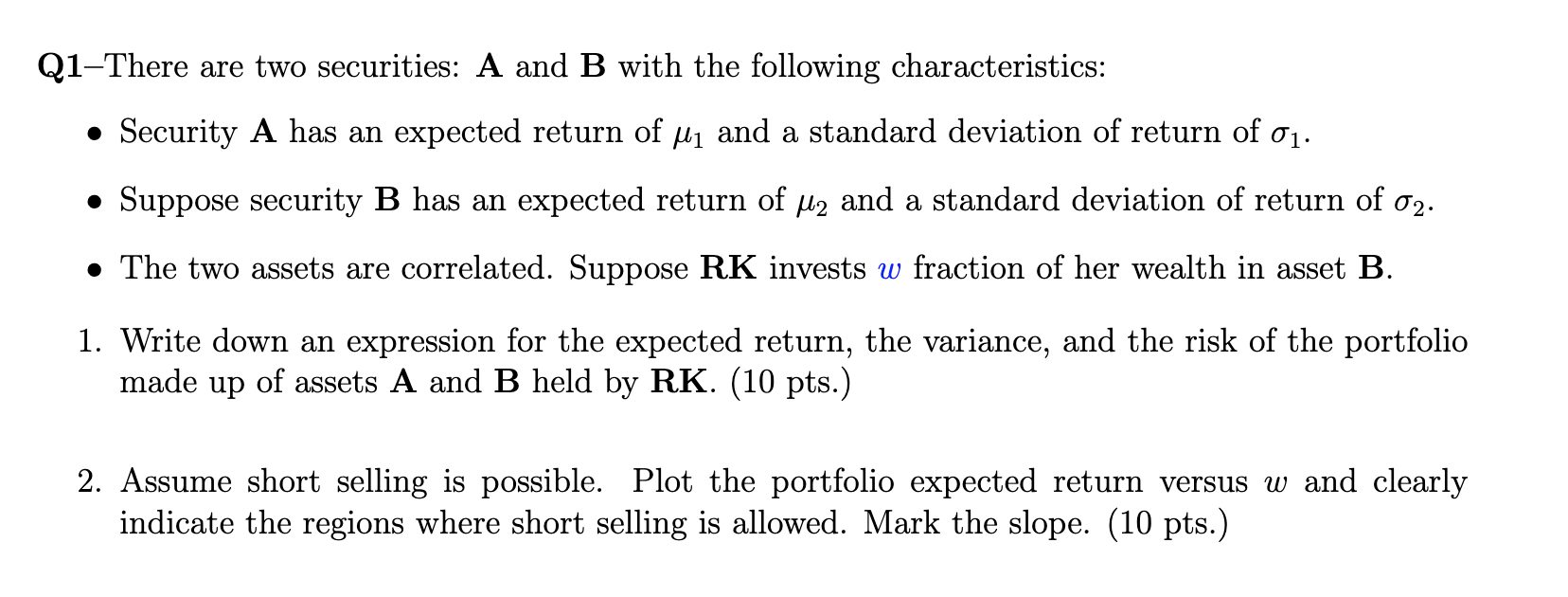

Q2-Refer to the same information as in Q1. 1. Assume both assets are perfectly positively correlated and asset B is riskier than asset A. Demonstrate that the portfolio risk & return are both linear in w. (10 pts.) 2. Determine w* such that the variance of portfolio has minimum risk and verify that the portfolio indeed attains a minimum. (10 pts.) 3. Interpret the results of optimal investment. (10 pts.) 4. Write down an expression for the expected return and the risk of the minimum risk portfolio. (10 pts.) 5. Assume assets A and B are correlated with a correlation coefficient p. Make no assumptions on the relative riskiness of the securities. Determine the optimal weights invested in each asset find the expected return and the risk associated with the optimal portfolio. (10 pts.) Q1-There are two securities: A and B with the following characteristics: Security A has an expected return of My and a standard deviation of return of 01. Suppose security B has an expected return of M2 and a standard deviation of return of 02. The two assets are correlated. Suppose RK invests w fraction of her wealth in asset B. 1. Write down an expression for the expected return, the variance, and the risk of the portfolio made up of assets A and B held by RK. (10 pts.) 2. Assume short selling is possible. Plot the portfolio expected return versus w and clearly indicate the regions where short selling is allowed. Mark the slope. (10 pts.) Q2-Refer to the same information as in Q1. 1. Assume both assets are perfectly positively correlated and asset B is riskier than asset A. Demonstrate that the portfolio risk & return are both linear in w. (10 pts.) 2. Determine w* such that the variance of portfolio has minimum risk and verify that the portfolio indeed attains a minimum. (10 pts.) 3. Interpret the results of optimal investment. (10 pts.) 4. Write down an expression for the expected return and the risk of the minimum risk portfolio. (10 pts.) 5. Assume assets A and B are correlated with a correlation coefficient p. Make no assumptions on the relative riskiness of the securities. Determine the optimal weights invested in each asset find the expected return and the risk associated with the optimal portfolio. (10 pts.) Q1-There are two securities: A and B with the following characteristics: Security A has an expected return of My and a standard deviation of return of 01. Suppose security B has an expected return of M2 and a standard deviation of return of 02. The two assets are correlated. Suppose RK invests w fraction of her wealth in asset B. 1. Write down an expression for the expected return, the variance, and the risk of the portfolio made up of assets A and B held by RK. (10 pts.) 2. Assume short selling is possible. Plot the portfolio expected return versus w and clearly indicate the regions where short selling is allowed. Mark the slope. (10 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts