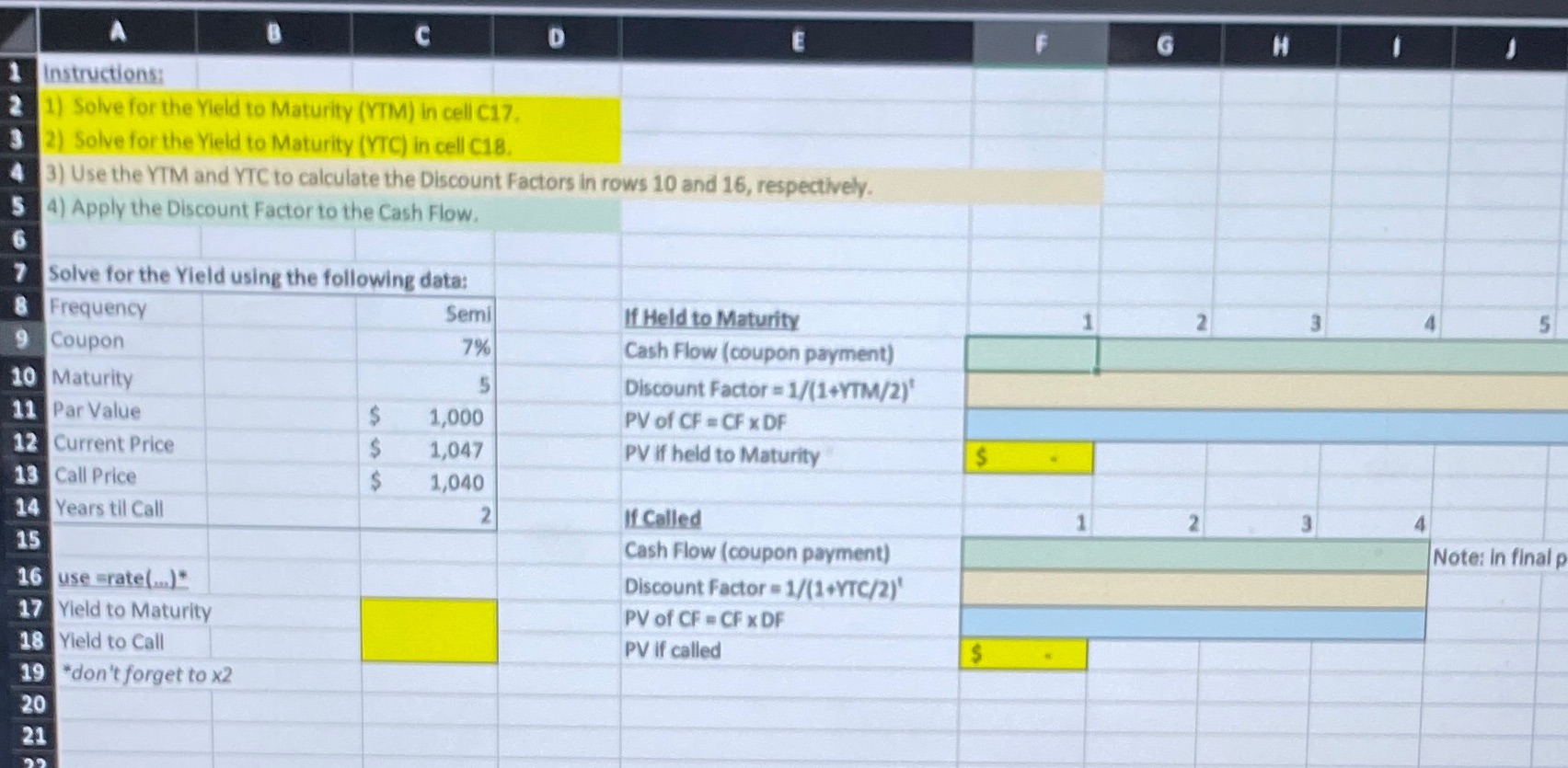

Question: Please solve for the empty highlighted boxes. Add the calculations you entered in the excel cells, to receive the answers. (#6-10 for cells F9-11, weren't

Please solve for the empty highlighted boxes. Add the calculations you entered in the excel cells, to receive the answers. (#6-10 for cells F9-11, weren't able to fit in this photo.)(For cell I4, it says "Note, in the final period, you also get the call price ($1040) in addition to the coupon)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts