Question: Please solve for the payback period for the different projects? Fitzgibbons Construction is analyzing its capital expenditure proposals for the purchase of equipment in the

Please solve for the payback period for the different projects?

Please solve for the payback period for the different projects?

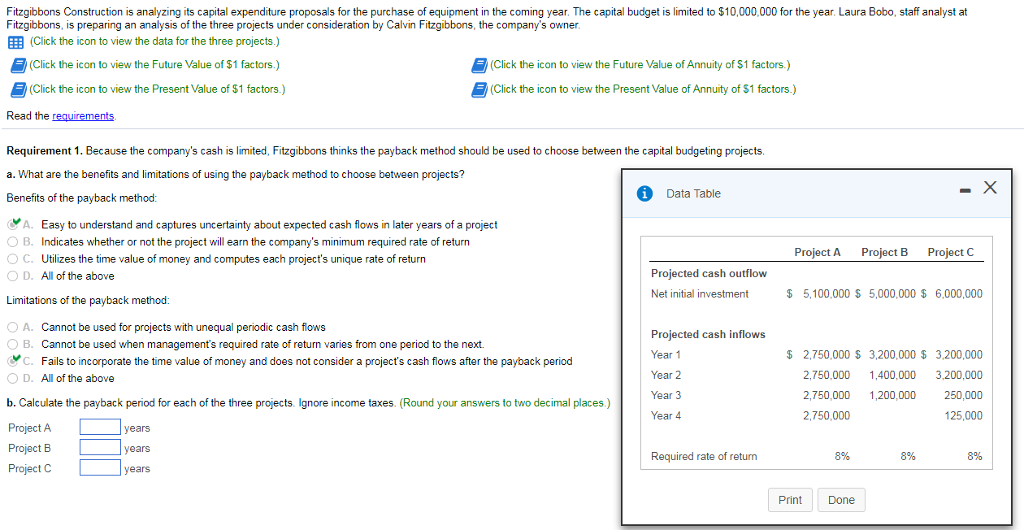

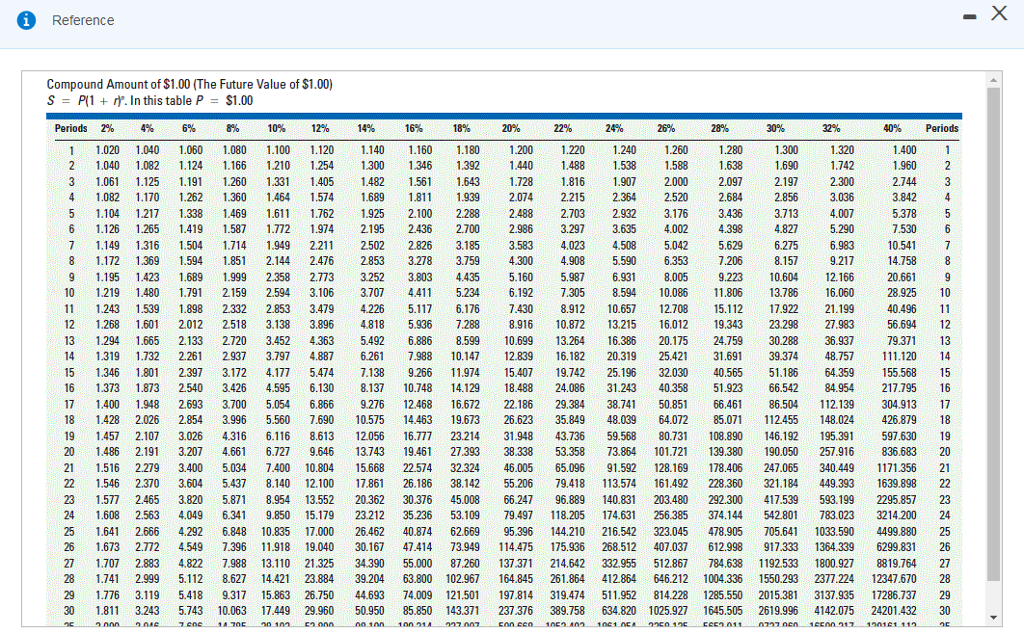

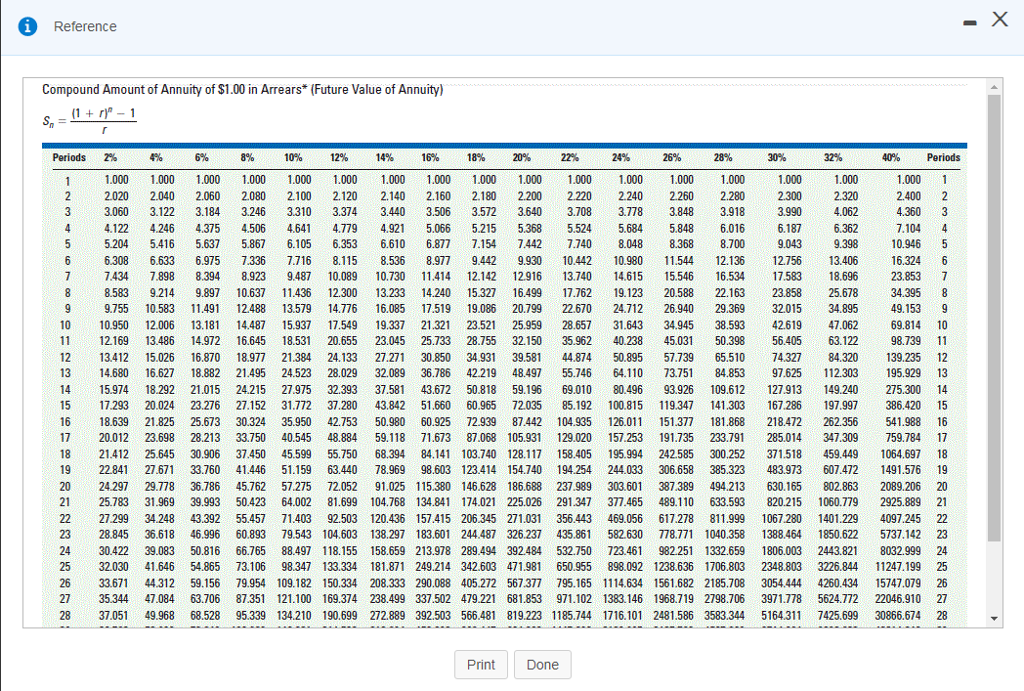

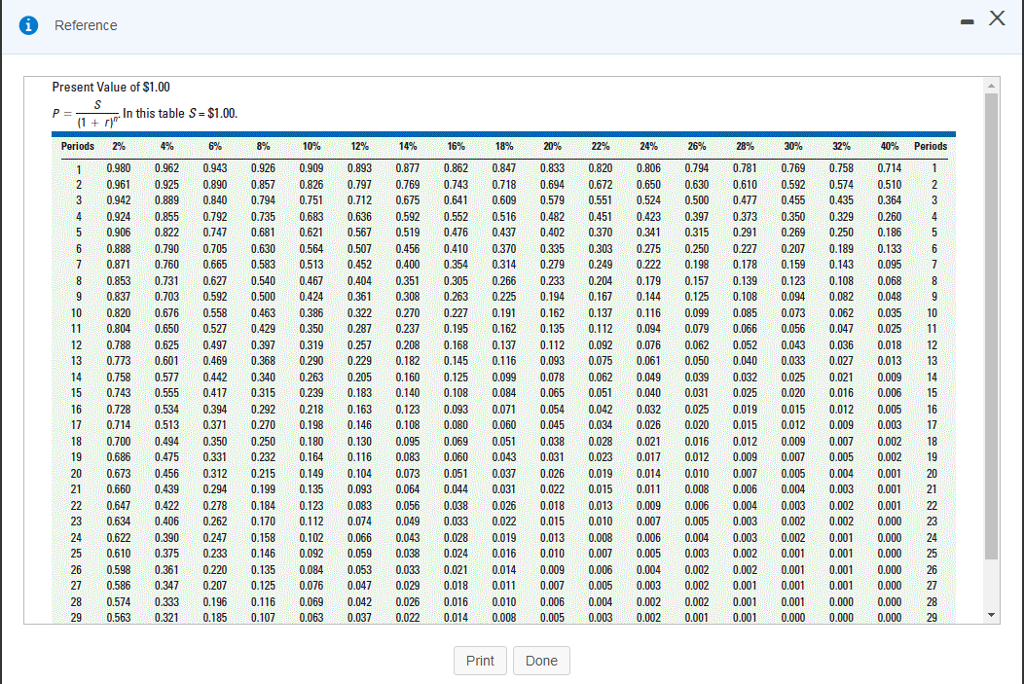

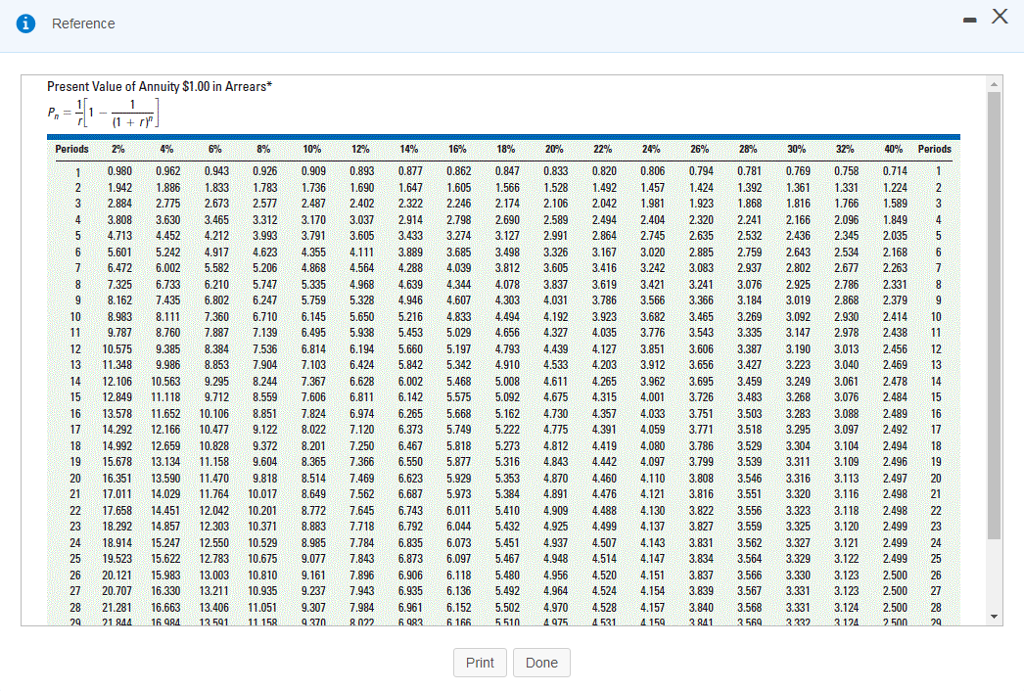

Fitzgibbons Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $10,000,000 for the year. Laura Bobo, staff analyst at Fitzgibbons, is preparing an analysis of the three projects under consideration by Calvin Fitzgibbons, the company's owner, (Click the icon to view the data for the three projects.) (Click the icon to view the Future Value of $1 factors.) (Click the icon to view the Present Value of $1 factors.) (Click the icon to view the Future Value of Annuity of $1 factors.) (Click the icon to view the Present Value of Annuity of $1 factors.) Read the requirements Requirement 1. Because the company's cash is limited, Fitzgibbons thinks the payback method should be used to choose between the capital budgeting projects a. What are the benefits and limitations of using the payback method to choose between projects? Benefits of the payback method: Data Table A. Easy to understand and captures uncertainty about expected cash flows in later years of a project O B. Indicates whether or not the project will earn the company's minimum required rate of return O C. Utilizes the time value of money and computes each project's unique rate of return 0 D. All of the above Project A Project B Project C Projected cash outflow Net initial investment $ 5,100,000 $ 5,000,000 $ 6,000,000 Limitations of the payback method: A. Cannot be used for projects with unequal periodic cash flows O B. Cannot be used when management's required rate of return varies from one period to the next C. Fails to incorporate the time value of money and does not consider a project's cash flows after the payback period ( D. Al of the above b. Calculate the payback period for each of the three projects Ignore income taxes. (Round your answers to two decimal places) Project A Project B Project C Projected cash inflows Year 1 Year 2 Year 3 Year 4 $ 2,750,000 $ 3,200,000 $ 3,200,000 2,750,000 1,400,000 3,200,000 2,750,000 1,200,000 250,000 125,000 2,750,000 years years years Required rate of return 3% 8% 8% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts