Question: Please solve given problem 2. 3 5 6 7 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY. THE PROJECT'S SALES, OPERATING COSTS, AND

Please solve given problem

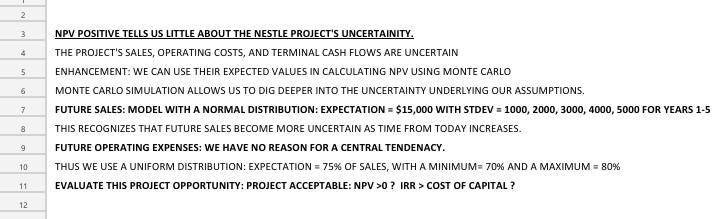

2. 3 5 6 7 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY. THE PROJECT'S SALES, OPERATING COSTS, AND TERMINAL CASH FLOWS ARE UNCERTAIN ENHANCEMENT: WE CAN USE THEIR EXPECTED VALUES IN CALCULATING NPV USING MONTE CARLO MONTE CARLO SIMULATION ALLOWS US TO DIG DEEPER INTO THE UNCERTAINTY UNDERLYING OUR ASSUMPTIONS. FUTURE SALES: MODEL WITH A NORMAL DISTRIBUTION: EXPECTATION = $15,000 WITH STDEV = 1000, 2000, 3000, 4000, 5000 FOR YEARS 1-5 THIS RECOGNIZES THAT FUTURE SALES BECOME MORE UNCERTAIN AS TIME FROM TODAY INCREASES. FUTURE OPERATING EXPENSES: WE HAVE NO REASON FOR A CENTRAL TENDENACY. THUS WE USE A UNIFORM DISTRIBUTION: EXPECTATION = 75% OF SALES, WITH A MINIMUM= 70% AND A MAXIMUM = 80% EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? 8 9 10 11 12 2. 3 5 6 7 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY. THE PROJECT'S SALES, OPERATING COSTS, AND TERMINAL CASH FLOWS ARE UNCERTAIN ENHANCEMENT: WE CAN USE THEIR EXPECTED VALUES IN CALCULATING NPV USING MONTE CARLO MONTE CARLO SIMULATION ALLOWS US TO DIG DEEPER INTO THE UNCERTAINTY UNDERLYING OUR ASSUMPTIONS. FUTURE SALES: MODEL WITH A NORMAL DISTRIBUTION: EXPECTATION = $15,000 WITH STDEV = 1000, 2000, 3000, 4000, 5000 FOR YEARS 1-5 THIS RECOGNIZES THAT FUTURE SALES BECOME MORE UNCERTAIN AS TIME FROM TODAY INCREASES. FUTURE OPERATING EXPENSES: WE HAVE NO REASON FOR A CENTRAL TENDENACY. THUS WE USE A UNIFORM DISTRIBUTION: EXPECTATION = 75% OF SALES, WITH A MINIMUM= 70% AND A MAXIMUM = 80% EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? 8 9 10 11 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts