Question: please solve handwritten, not excel. show work/formulas. will upvote once answered. thank you in advance! (35 pts) There are two stocks: A and B, and

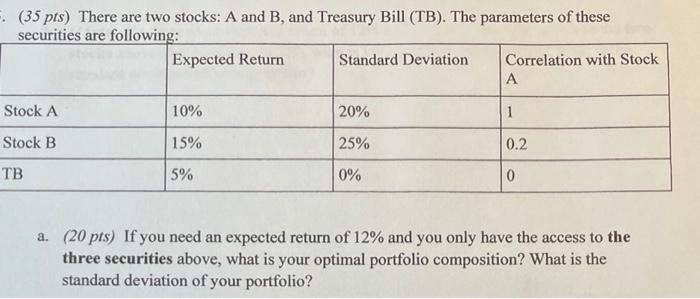

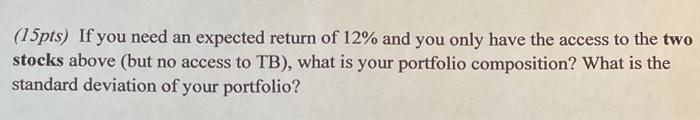

(35 pts) There are two stocks: A and B, and Treasury Bill (TB). The parameters of these securities are following: Expected Return Standard Deviation Correlation with Stock A Stock A 10% 20% 1 Stock B 15% 25% 0.2 TB 5% 0% 0 a. (20 pts) If you need an expected return of 12% and you only have the access to the three securities above, what is your optimal portfolio composition? What is the standard deviation of your portfolio? (15pts) If you need an expected return of 12% and you only have the access to the two stocks above (but no access to TB), what is your portfolio composition? What is the standard deviation of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts