Question: please solve ik its a one question limit A share of preferred stock with an annual dividend of $12 has an expected return of 2.5%

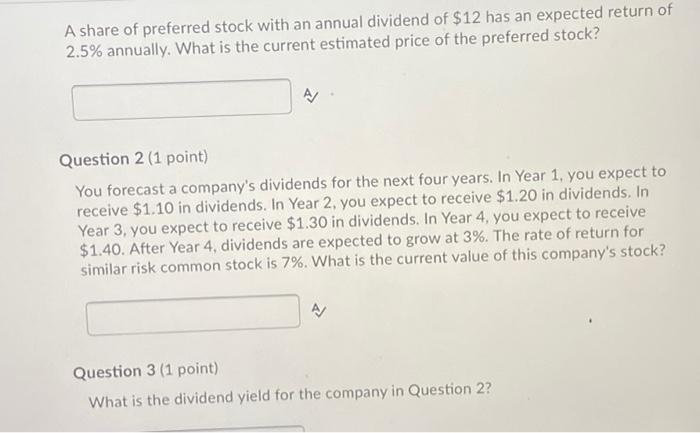

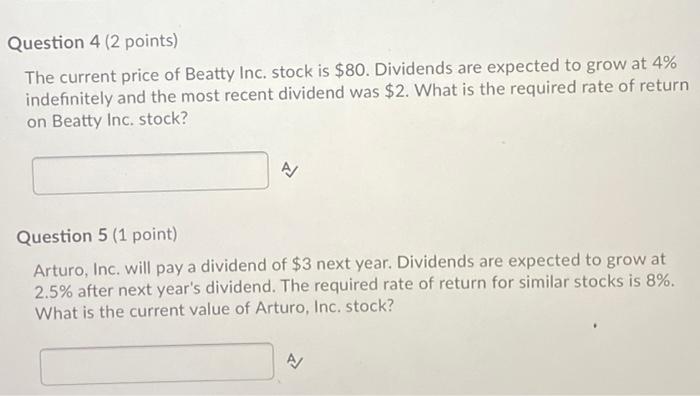

A share of preferred stock with an annual dividend of $12 has an expected return of 2.5% annually. What is the current estimated price of the preferred stock? Question 2 (1 point) You forecast a company's dividends for the next four years. In Year 1, you expect to receive $1.10 in dividends. In Year 2, you expect to receive $1.20 in dividends. In Year 3, you expect to receive $1.30 in dividends. In Year 4. you expect to receive $1.40. After Year 4, dividends are expected to grow at 3%. The rate of return for similar risk common stock is 7%. What is the current value of this company's stock? Question 3 (1 point) What is the dividend yield for the company in Question 2? Question 4 (2 points) The current price of Beatty Inc. stock is $80. Dividends are expected to grow at 4% indefinitely and the most recent dividend was $2. What is the required rate of return on Beatty Inc. stock? P/ Question 5 (1 point) Arturo, Inc. will pay a dividend of $3 next year. Dividends are expected to grow at 2.5% after next year's dividend. The required rate of return for similar stocks is 8%. What is the current value of Arturo, Inc. stock?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts