Question: Please Solve In 15mins Exercise 14-5 (Algorithmic) (LO. 3) Candlewood LLC began its business on July 1, 2022: and it uses a calendar tax and

Please Solve In 15mins

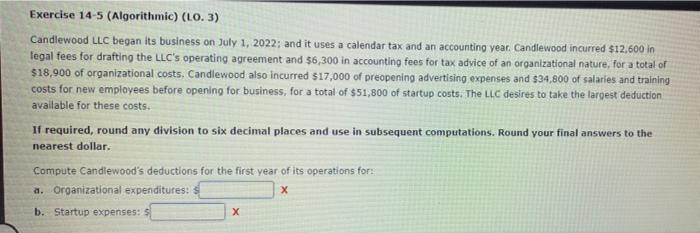

Exercise 14-5 (Algorithmic) (LO. 3) Candlewood LLC began its business on July 1, 2022: and it uses a calendar tax and an accounting year. Candlewood incurred $12,600 in legal fees for drafting the LLC's operating agreement and $6,300 in accounting fees for tax advice of an organizational nature, for a total of $18,900 of organizational costs. Candlewood also incurred $17,000 of preopening advertising expenses and $34,800 of salaries and training costs for new employees before opening for business, for a total of $51,800 of startup costs. The LLC desires to take the largest deduction available for these costs. If required, round any division to six decimal places and use in subsequent computations. Round your final answers to the nearest dollar. Compute Candlewood's deductions for the first year of its operations for: a. Organizational expenditures: b. Startup expenses: 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts