Question: please solve in 60 mins i will give thumb up 1 Question 2 Parts A, B, and C Please highlight your answers You are a

please solve in 60 mins i will give thumb up

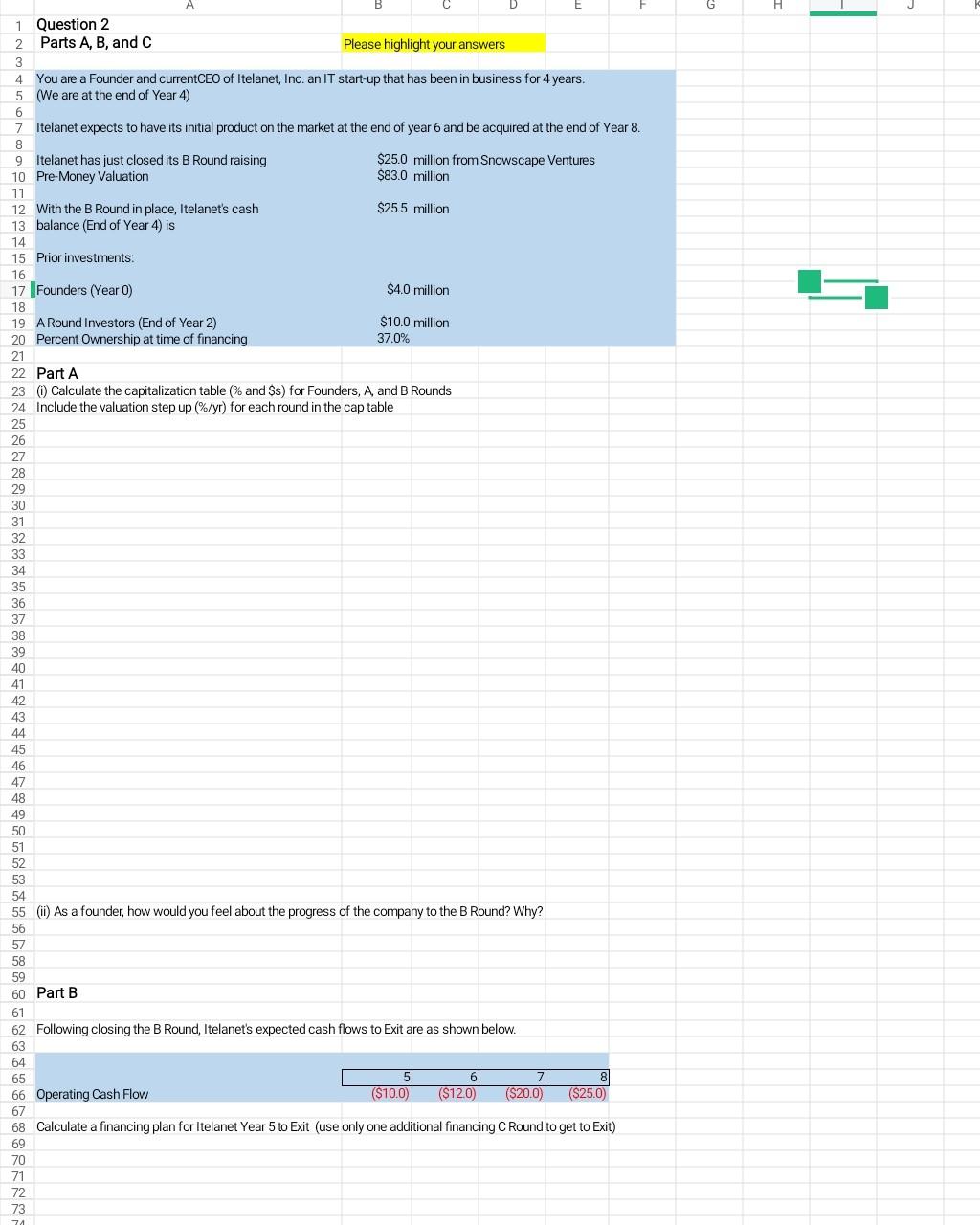

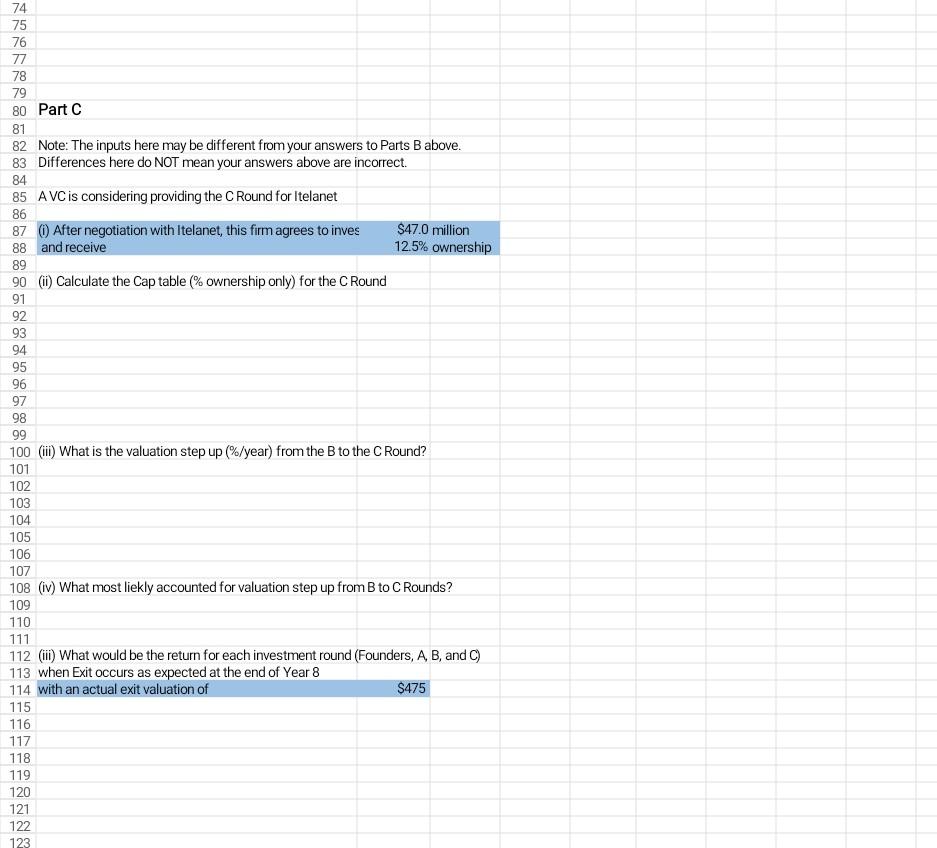

1 Question 2 Parts A, B, and C Please highlight your answers You are a Founder and currentCEO of Itelanet, Inc. an IT start-up that has been in business for 4 years. (We are at the end of Year 4) Itelanet expects to have its initial product on the market at the end of year 6 and be acquired at the end of Year 8 . Itelanet has just closed its B Round raising $25.0 million from Snowscape Ventures 10 Pre-Money Valuation $83.0 million 11 12 With the B Round in place, Itelanet's cash \$25.5 million 13 balance (End of Year 4) is 14 15 Prior investments: 16 17 Founders (Year 0) \$4.0 million 18 19 ARound Investors (End of Year 2) $10.0 million 20 Percent Ownership at time of financing 21 22 Part A 23 (i) Calculate the capitalization table (\% and $s ) for Founders, A and B Rounds Include the valuation step up (%/yr) for each round in the cap table (ii) As a founder, how would you feel about the progress of the company to the B Round? Why? Part B Following closing the B Round, Itelanet's expected cash flows to Exit are as shown below. 63 64 65 66 Operating Cash Flow \begin{tabular}{|r|r|r|r|} \hline 5 & 6 & 7 & 8 \\ \hline($10.0) & ($12.0) & ($20.0) & ($25.0) \\ \hline \end{tabular} 68 Calculate a financing plan for Itelanet Year 5 to Exit (use only one additional financing C Round to get to Exit) 1 Question 2 Parts A, B, and C Please highlight your answers You are a Founder and currentCEO of Itelanet, Inc. an IT start-up that has been in business for 4 years. (We are at the end of Year 4) Itelanet expects to have its initial product on the market at the end of year 6 and be acquired at the end of Year 8 . Itelanet has just closed its B Round raising $25.0 million from Snowscape Ventures 10 Pre-Money Valuation $83.0 million 11 12 With the B Round in place, Itelanet's cash \$25.5 million 13 balance (End of Year 4) is 14 15 Prior investments: 16 17 Founders (Year 0) \$4.0 million 18 19 ARound Investors (End of Year 2) $10.0 million 20 Percent Ownership at time of financing 21 22 Part A 23 (i) Calculate the capitalization table (\% and $s ) for Founders, A and B Rounds Include the valuation step up (%/yr) for each round in the cap table (ii) As a founder, how would you feel about the progress of the company to the B Round? Why? Part B Following closing the B Round, Itelanet's expected cash flows to Exit are as shown below. 63 64 65 66 Operating Cash Flow \begin{tabular}{|r|r|r|r|} \hline 5 & 6 & 7 & 8 \\ \hline($10.0) & ($12.0) & ($20.0) & ($25.0) \\ \hline \end{tabular} 68 Calculate a financing plan for Itelanet Year 5 to Exit (use only one additional financing C Round to get to Exit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts