Question: Please solve in an excel format and show me the formulas used to get solution. Thank you fx B E F H j K L

Please solve in an excel format and show me the formulas used to get solution. Thank you

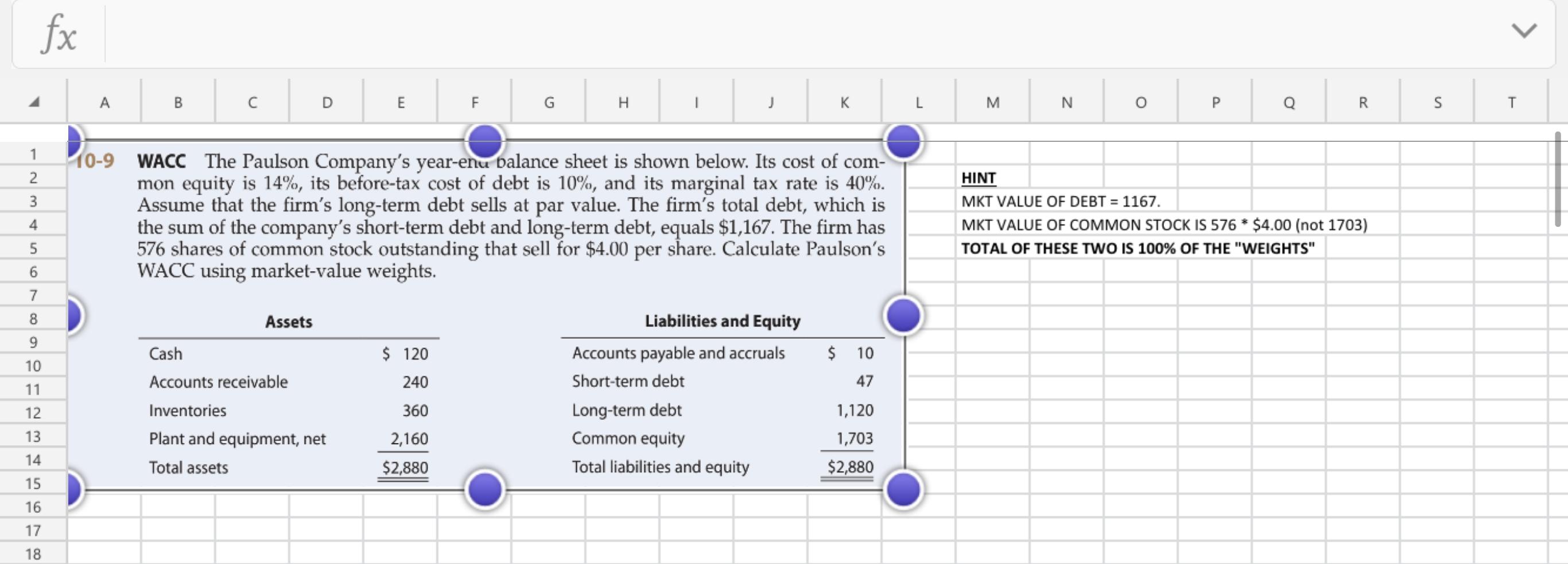

fx B E F H j K L M N Q R S T 1 2 3 10-9 WACC The Paulson Company's year-enu balance sheet is shown below. Its cost of com- mon equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 40%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,167. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Calculate Paulson's WACC using market value weights. HINT MKT VALUE OF DEBT = 1167. MKT VALUE OF COMMON STOCK IS 576 * $4.00 (not 1703) TOTAL OF THESE TWO IS 100% OF THE "WEIGHTS" 4 5 6 7 8 Assets 9 10 $ 120 240 $ 10 47 11 Liabilities and Equity Accounts payable and accruals Short-term debt Long-term debt Common equity Total liabilities and equity Cash Accounts receivable Inventories Plant and equipment, net Total assets 12 13 360 1,120 1,703 $2,880 2,160 $2,880 14 15 16 17 18 fx B E F H j K L M N Q R S T 1 2 3 10-9 WACC The Paulson Company's year-enu balance sheet is shown below. Its cost of com- mon equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 40%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,167. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Calculate Paulson's WACC using market value weights. HINT MKT VALUE OF DEBT = 1167. MKT VALUE OF COMMON STOCK IS 576 * $4.00 (not 1703) TOTAL OF THESE TWO IS 100% OF THE "WEIGHTS" 4 5 6 7 8 Assets 9 10 $ 120 240 $ 10 47 11 Liabilities and Equity Accounts payable and accruals Short-term debt Long-term debt Common equity Total liabilities and equity Cash Accounts receivable Inventories Plant and equipment, net Total assets 12 13 360 1,120 1,703 $2,880 2,160 $2,880 14 15 16 17 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts