Question: please solve in excel and provide explanation Problem 154 Klein Book Store uses the conventional retail method and is now considering converting to the LIFO

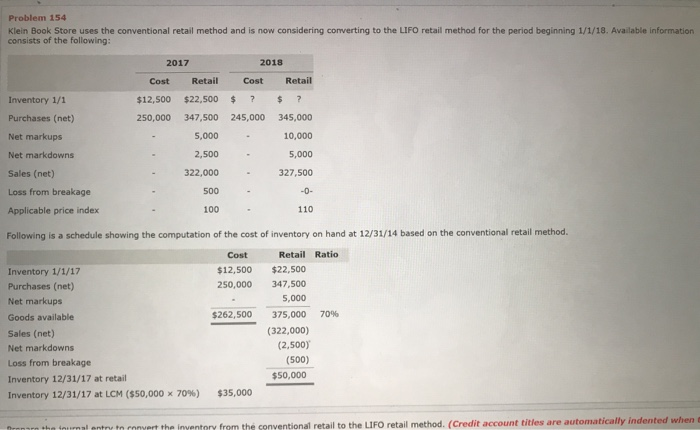

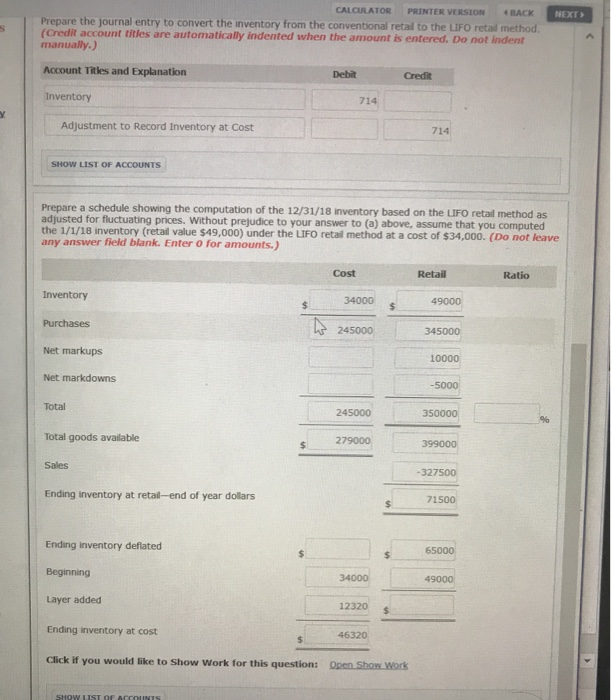

Problem 154 Klein Book Store uses the conventional retail method and is now considering converting to the LIFO retail method for the period beginning 1/1/18. Available information consists of the following: 2017 2018 Retail Retail Cost Cost $12,500 Inventory 1/1 $22,500 Purchases (net) 250,000 347,500 245,000 345,000 5,000 10,000 Net markups 2,500 5,000 Net markdowns Sales (net) 322.000 327,500 -0- Loss from breakage 500 100 Applicable price index 110 Following is a schedule showing the computation of the cost of inventory on hand at 12/31/14 based on the conventional retail Cost Retail Ratio $12,500 $22,500 Inventory 1/1/17 250,000 347,500 Purchases (net) 5,000 Net markups $262,500 375,000 70% Goods available (322,000) Sales (net) (2,500) Net markdowns (500) Loss from breakage $50,000 Inventory 12/31/17 at retail $35,000 Inventory 12/31/17 at LCM ($50,000 x 70% ) fronarn the tnurnal entry tn convert the inventory from the conventional retail to the LIFO retail method, (Credit account titles are automatically indented when CALCULATOR PRINTER VERSION 4 BACK NEXT Prepare the journal entry to convert the inventory from the conventional retal to the LIFO retal method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Inventory 714 Adjustment to Record Inventory at Cost 714 SHOW LIST OF ACCOUNTS Prepare a schedule showing the computation of the 12/31/18 inventory based on the LIFO retail method as adjusted for fluctuating prices. Without prejudice to your answer to (a) above, assume that you computed the 1/1/18 invent any answer field blank. Enter 0 for amounts.) y (retal value $49,000) under the LIFO retail method at a cost of $34,000. (Do not leave Retail Cost Ratio Inventory 34000 49000 Purchases 245000 345000 Net markups 10000 Net markdowns -5000 Total 245000 350000 Total goods available 279000 399000 Sales -327500 Ending inventory at retail-end of year dollars 71500 S Ending inventory deflated 65000 Beginning 34000 49000 Layer added 12320 Ending inventory at cost 46320 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts