Question: please solve in excel Input Bond X: Coupon rate Face value Coupons per year Years to maturity Current price Bond Y: Coupon rate Face value

please solve in excel

please solve in excel

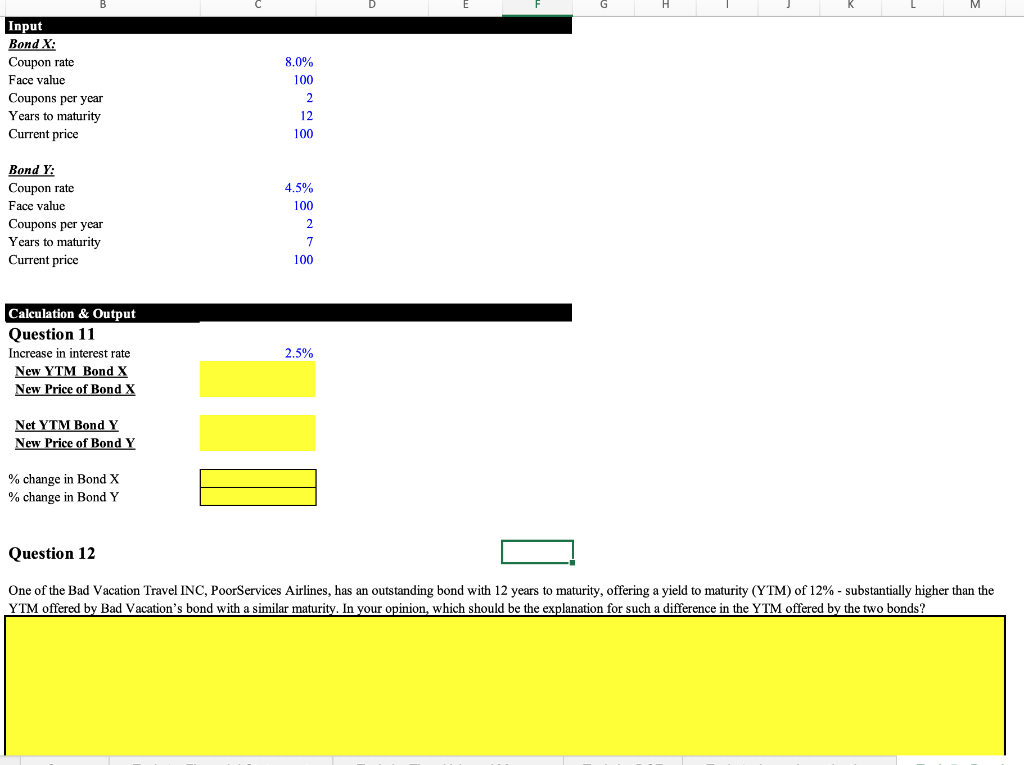

Input Bond X: Coupon rate Face value Coupons per year Years to maturity Current price Bond Y: Coupon rate Face value Coupons per year Years to maturity Current price 100 Calculation & Output Question 11 Increase in interest rate 2.5% New YTM Bond X New Price of Bond X Net YTM Bond Y New Price of Bond Y % change in Bond X % change in Bond Y Question 12 One of the Bad Vacation Travel INC, PoorServices Airlines, has an outstanding bond with 12 years to maturity, offering a yield to maturity (YTM) of 12% - substantially higher than the YTM offered by Bad Vacation's bond with a similar maturity. In your opinion, which should be the explanation for such a difference in the YTM offered by the two bonds? 8.0% 100 2 12 100 4.5% 100 2 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts