Question: Please solve in excel sheet. Thank you! Please solve in excel sheet. Thank you! Giannis currently has $1 million in cash available. He plans to

Please solve in excel sheet. Thank you!

Please solve in excel sheet. Thank you!

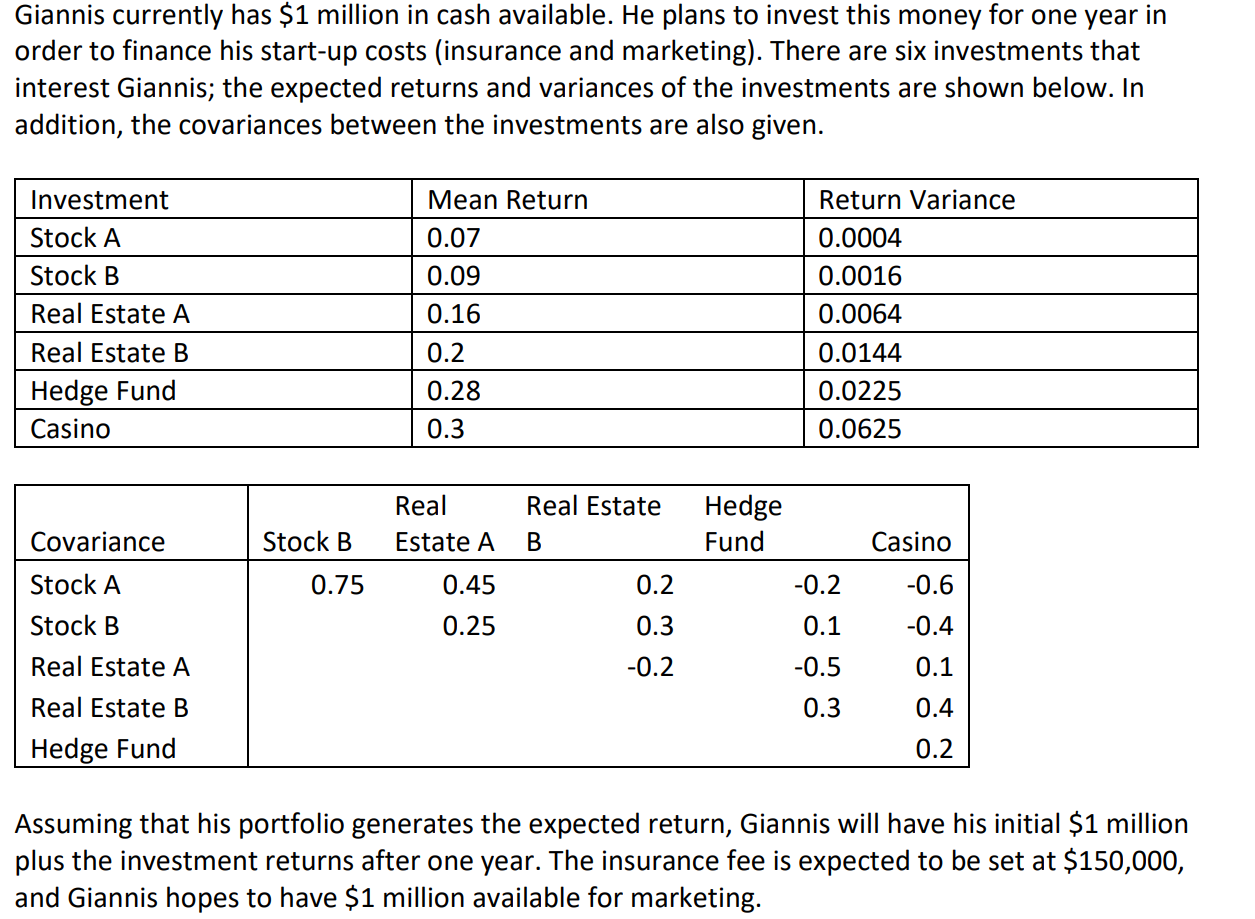

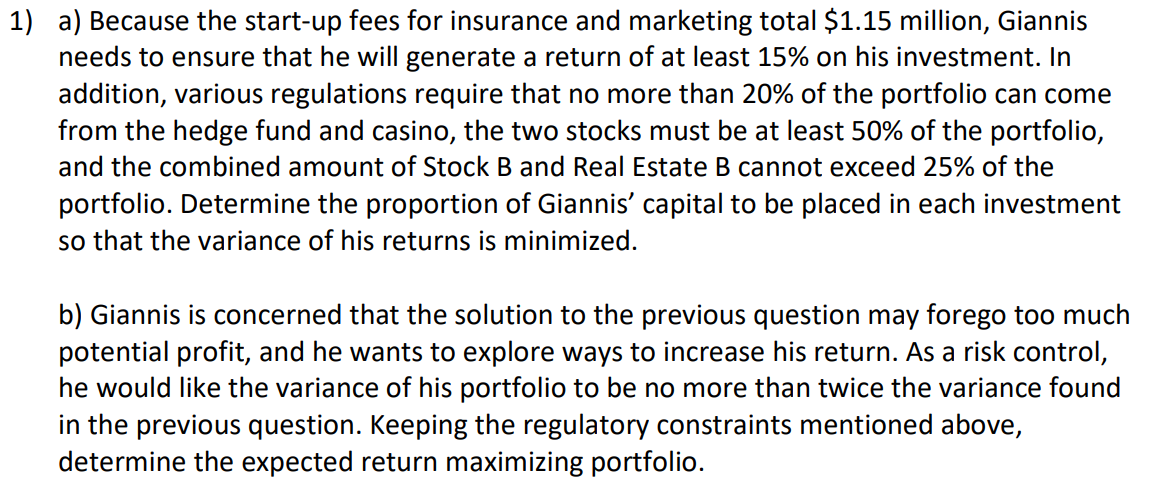

Giannis currently has $1 million in cash available. He plans to invest this money for one year in order to finance his start-up costs (insurance and marketing). There are six investments that interest Giannis; the expected returns and variances of the investments are shown below. In addition, the covariances between the investments are also given. Assuming that his portfolio generates the expected return, Giannis will have his initial $1 million plus the investment returns after one year. The insurance fee is expected to be set at $150,000, and Giannis hopes to have $1 million available for marketing. a) Because the start-up fees for insurance and marketing total $1.15 million, Giannis needs to ensure that he will generate a return of at least 15% on his investment. In addition, various regulations require that no more than 20% of the portfolio can come from the hedge fund and casino, the two stocks must be at least 50% of the portfolio, and the combined amount of Stock B and Real Estate B cannot exceed 25\% of the portfolio. Determine the proportion of Giannis' capital to be placed in each investment so that the variance of his returns is minimized. b) Giannis is concerned that the solution to the previous question may forego too much potential profit, and he wants to explore ways to increase his return. As a risk control, he would like the variance of his portfolio to be no more than twice the variance found in the previous question. Keeping the regulatory constraints mentioned above, determine the expected return maximizing portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts