Question: PLEASE SOLVE IN EXCEL!!! SHOW FORMULAS AS WELL, IF YOU'RE UNABLE TO DO SO, LET SOMEONE ELSE DO IT. THANK YOU! REITs pay dividends in

PLEASE SOLVE IN EXCEL!!! SHOW FORMULAS AS WELL, IF YOU'RE UNABLE TO DO SO, LET SOMEONE ELSE DO IT. THANK YOU!

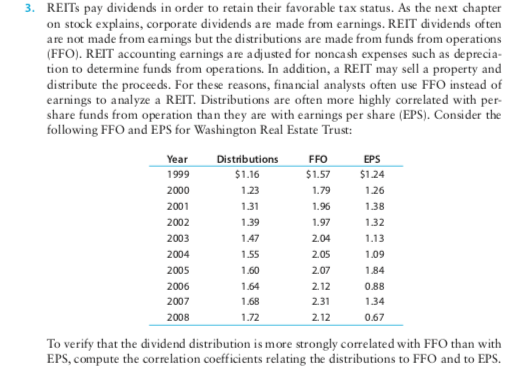

REITs pay dividends in order to retain their favorable tax status. As the next chapter on stock explains, corporate dividends are made from earnings. REIT dividends often are not made from earnings but the distributions are made from funds from operations (FFO). REIT accounting earnings are adjusted for noncash expenses such as deprecia- tion to determine funds from operations. In addition, a REIT may sell a property and distribute the proceeds. For these reasons, financial analysts often use FFO instead of earnings to analyze a REIT. Distributions are often more highly correlated with per- share funds from operation than they are with earnings per share (EPS). Consider the following FFO and EPS for Washington Real Estate Trust: Year Distributions 1999 $1.16 2000 1.23 2001 1.31 2002 1.39 2003 1.47 2004 1.55 2005 1.60 2006 1.64 2007 1.68 2008 1.72 FFO EPS $1.57 $1.24 1.79 1.26 1.96 1.38 1.97 1.32 2.04 1.13 2.05 1.09 2.07 1.84 2.12 0.88 2.31 1.34 2.12 0.67 To verify that the dividend distribution is more strongly correlated with FFO than with EPS, compute the correlation coefficients relating the distributions to FFO and to EPS.

3. REITs pay dividends in order to retain their favorable tax status. As the next chapter on stock explains, corporate dividends are made from earnings. REIT dividends often are not made from earings but the distributions are made from funds from operations (FFO). REIT accounting earnings are adjusted for noncash expenses such as deprecia- tion to determine funds from operations. In addition, a REIT may sell a property and distribute the proceeds. For these reasons, financial analysts often use FFO instead of earnings to analyze a REIT. Distributions are often more highly correlated with per- share funds from operation than they are with earnings per share (EPS). Consider the following FFO and EPS for Washington Real Estate Trust: Year Distributions FFO EPS 1999 $1.16 $1.57 $1.24 2000 1.23 1.79 1.26 2001 2002 2003 1.47 2.04 1.13 2004 1.09 2005 1.60 2.07 1.84 2006 1.64 2.12 0.88 2007 2.31 1.34 2008 2.12 0.67 1.31 1.39 1.96 1.97 1.38 1.32 1.55 2.05 1.68 1.72 To verify that the dividend distribution is more strongly correlated with FFO than with EPS, compute the correlation coefficients relating the distributions to FFO and to EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts