Question: Please solve in excel showing functions thank you ! Cara has recently retired and is now considering starting a new business of selling tacos at

Please solve in excel showing functions thank you !

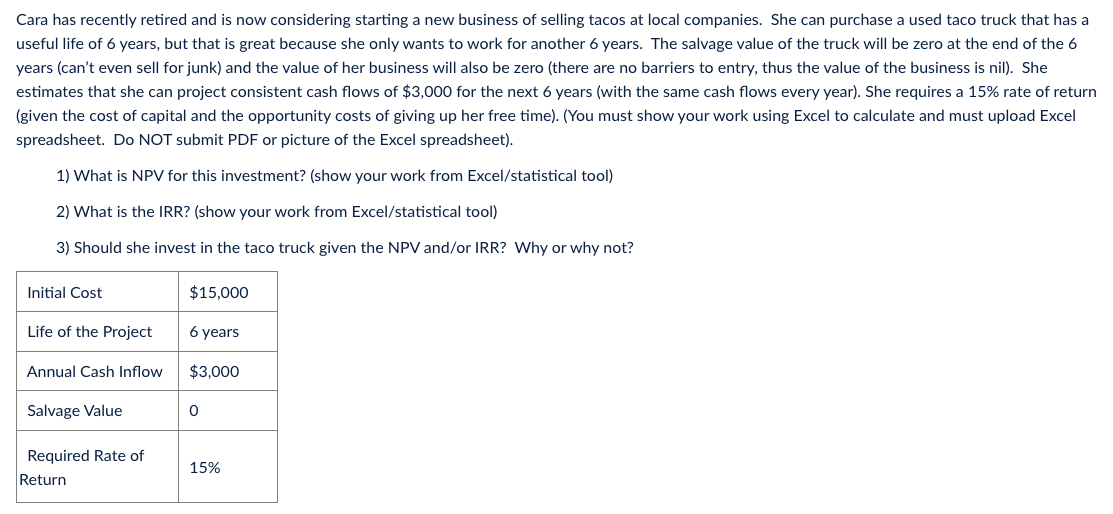

Cara has recently retired and is now considering starting a new business of selling tacos at local companies. She can purchase a used taco truck that has a useful life of 6 years, but that is great because she only wants to work for another 6 years. The salvage value of the truck will be zero at the end of the 6 years (can't even sell for junk) and the value of her business will also be zero (there are no barriers to entry, thus the value of the business is nil). She estimates that she can project consistent cash flows of $3,000 for the next 6 years (with the same cash flows every year). She requires a 15% rate of return (given the cost of capital and the opportunity costs of giving up her free time). (You must show your work using Excel to calculate and must upload Excel spreadsheet. Do NOT submit PDF or picture of the Excel spreadsheet). 1) What is NPV for this investment? (show your work from Excel/statistical tool) 2) What is the IRR? (show your work from Excel/statistical tool) 3) Should she invest in the taco truck given the NPV and/or IRR? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts