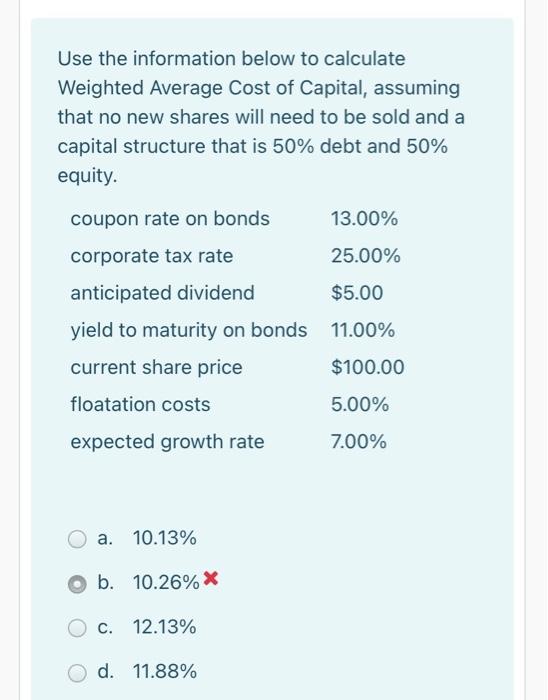

Question: please solve in excel showing the work Use the information below to calculate Weighted Average Cost of Capital, assuming that no new shares will need

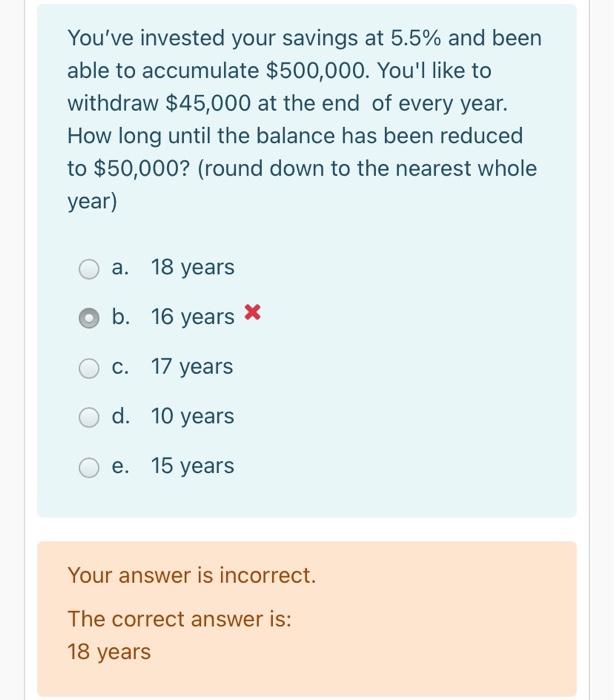

Use the information below to calculate Weighted Average Cost of Capital, assuming that no new shares will need to be sold and a capital structure that is 50% debt and 50% equity. coupon rate on bonds 13.00% corporate tax rate 25.00% anticipated dividend $5.00 yield to maturity on bonds 11.00% current share price $100.00 floatation costs 5.00% expected growth rate 7.00% a. 10.13% O b. 10.26%* C. 12.13% d. 11.88% You've invested your savings at 5.5% and been able to accumulate $500,000. You'l like to withdraw $45,000 at the end of every year. How long until the balance has been reduced to $50,000? (round down to the nearest whole year) a. 18 years b. 16 years * c. 17 years d. 10 years e. 15 years Your answer is incorrect. The correct answer is: 18 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts