Question: Please Solve in Excel with Excel Formula: 3) A bond currently sells for $850. It has an eight-year maturity, an annual coupon of $80 but

Please Solve in Excel with Excel Formula:

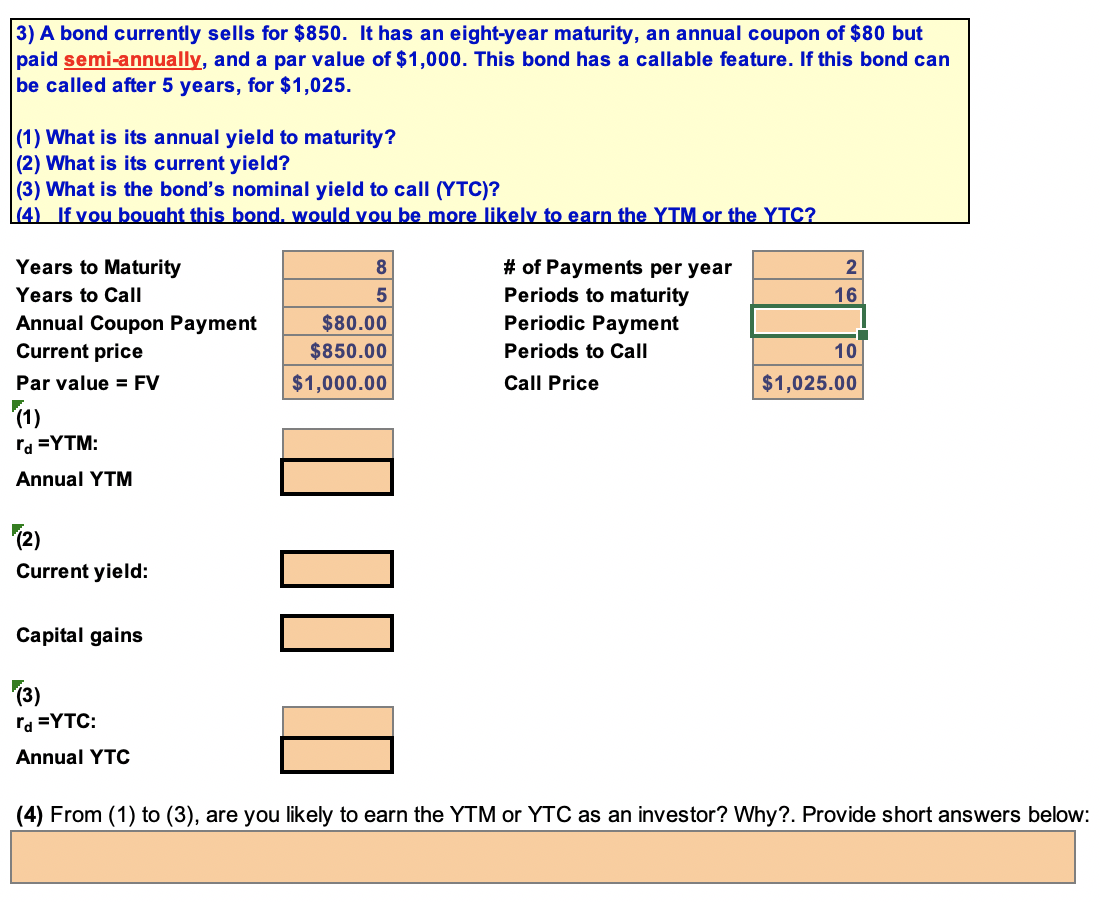

3) A bond currently sells for $850. It has an eight-year maturity, an annual coupon of $80 but paid semi-annually, and a par value of $1,000. This bond has a callable feature. If this bond can be called after 5 years, for $1,025. (1) What is its annual yield to maturity? (2) What is its current yield? (3) What is the bond's nominal yield to call (YTC)? (4) If you bought this bond, would you be more likely to earn the YTM or the YTC? Years to Maturity Years to Call Annual Coupon Payment Current price Par value = FV $80.00 $850.00 $1,000.00 # of Payments per year Periods to maturity Periodic Payment Periods to Call Call Price 10 $1,025.00 (1) ra=YTM: Annual YTM F(2) Current yield: Capital gains (3) ra =YTC: Annual YTC (4) From (1) to (3), are you likely to earn the YTM or YTC as an investor? Why?. Provide short answers below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts