Question: please solve in quickbooks and send the solution - Kssignment - Enter the following transactions using the new sample file. You will be submitting reports

please solve in quickbooks and send the solution

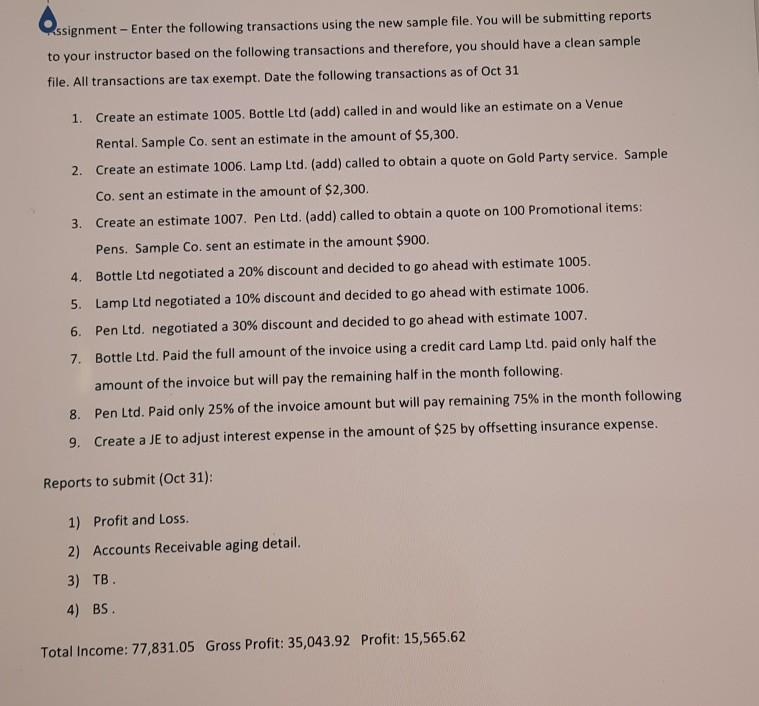

- Kssignment - Enter the following transactions using the new sample file. You will be submitting reports to your instructor based on the following transactions and therefore, you should have a clean sample file. All transactions are tax exempt. Date the following transactions as of Oct 31 1. Create an estimate 1005. Bottle Ltd (add) called in and would like an estimate on a Venue Rental. Sample Co. sent an estimate in the amount of $5,300. 2. Create an estimate 1006. Lamp Ltd. (add) called to obtain a quote on Gold Party service. Sample Co. sent an estimate in the amount of $2,300. 3. Create an estimate 1007. Pen Ltd. (add) called to obtain a quote on 100 Promotional items: Pens. Sample Co. sent an estimate in the amount $900. 4. Bottle Ltd negotiated a 20% discount and decided to go ahead with estimate 1005. 5. Lamp Ltd negotiated a 10% discount and decided to go ahead with estimate 1006. 6. Pen Ltd. negotiated a 30% discount and decided to go ahead with estimate 1007. 7. Bottle Ltd. Paid the full amount of the invoice using a credit card Lamp Ltd. paid only half the amount of the invoice but will pay the remaining half in the month following. 8. Pen Ltd. Paid only 25% of the invoice amount but will pay remaining 75% in the month following 9. Create a JE to adjust interest expense in the amount of $25 by offsetting insurance expense. Reports to submit (Oct 31): 1) Profit and Loss. 2) Accounts Receivable aging detail. 3) TB. 4) BS. Total Income: 77,831.05 Gross Profit: 35,043.92 Profit: 15,565.62 - Kssignment - Enter the following transactions using the new sample file. You will be submitting reports to your instructor based on the following transactions and therefore, you should have a clean sample file. All transactions are tax exempt. Date the following transactions as of Oct 31 1. Create an estimate 1005. Bottle Ltd (add) called in and would like an estimate on a Venue Rental. Sample Co. sent an estimate in the amount of $5,300. 2. Create an estimate 1006. Lamp Ltd. (add) called to obtain a quote on Gold Party service. Sample Co. sent an estimate in the amount of $2,300. 3. Create an estimate 1007. Pen Ltd. (add) called to obtain a quote on 100 Promotional items: Pens. Sample Co. sent an estimate in the amount $900. 4. Bottle Ltd negotiated a 20% discount and decided to go ahead with estimate 1005. 5. Lamp Ltd negotiated a 10% discount and decided to go ahead with estimate 1006. 6. Pen Ltd. negotiated a 30% discount and decided to go ahead with estimate 1007. 7. Bottle Ltd. Paid the full amount of the invoice using a credit card Lamp Ltd. paid only half the amount of the invoice but will pay the remaining half in the month following. 8. Pen Ltd. Paid only 25% of the invoice amount but will pay remaining 75% in the month following 9. Create a JE to adjust interest expense in the amount of $25 by offsetting insurance expense. Reports to submit (Oct 31): 1) Profit and Loss. 2) Accounts Receivable aging detail. 3) TB. 4) BS. Total Income: 77,831.05 Gross Profit: 35,043.92 Profit: 15,565.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts