Question: Please solve in simple and brief steps by writing the solution and not uploading an image Answer the following questions: (show your work) 1) A

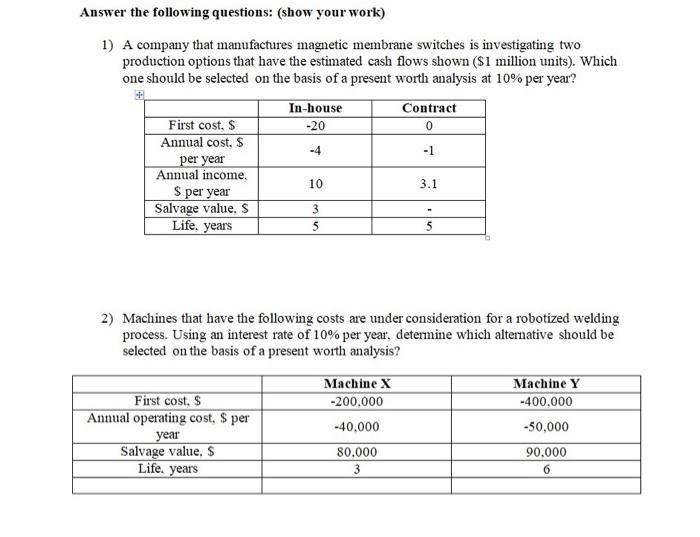

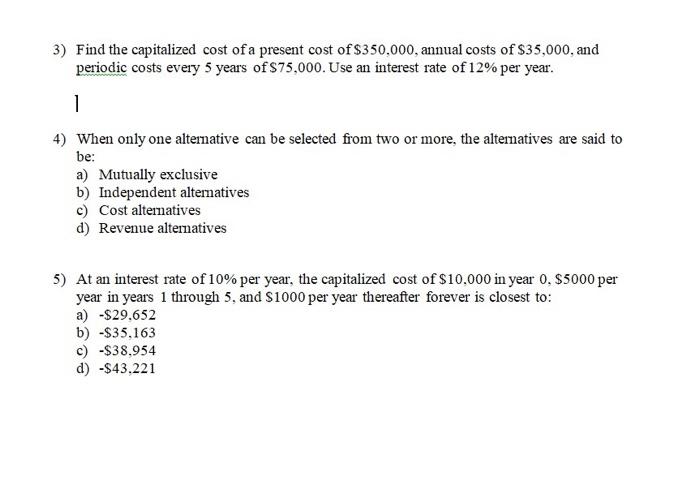

Answer the following questions: (show your work) 1) A company that manufactures magnetic membrane switches is investigating two production options that have the estimated cash flows shown ($1 million units). Which one should be selected on the basis of a present worth analysis at 10% per year? In-house Contract First cost, $ 0 Annual cost, $ per year Annual income, $ per year Salvage value, s Life, years -20 -4 10 3.1 3 5 5 2) Machines that have the following costs are under consideration for a robotized welding process. Using an interest rate of 10% per year, determine which alternative should be selected on the basis of a present worth analysis? Machine X Machine Y First cost, $ -200.000 -400,000 Annual operating cost, $ per -40.000 -50,000 year Salvage value. S 80.000 90,000 Life. years 3 6 3) Find the capitalized cost of a present cost of $350,000, annual costs of $35,000, and periodic costs every 5 years of $75,000. Use an interest rate of 12% per year. 1 4) When only one alterative can be selected from two or more, the alternatives are said to be: a) Mutually exclusive b) Independent alternatives c) Cost alternatives d) Revenue alternatives 5) At an interest rate of 10% per year, the capitalized cost of $10,000 in year 0. 55000 per year in years 1 through 5, and $1000 per year thereafter forever is closest to: a) -$29,652 b) -$35.163 c) -$38,954 d) -$43.221

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts