Question: please solve it. 22:25 0 0 . Total Stockholder's Equity Total Liabilities and Stockholders Equity $777,730 $720.000 Final Assessm... Manatee Inc. Income Statement For the

please solve it.

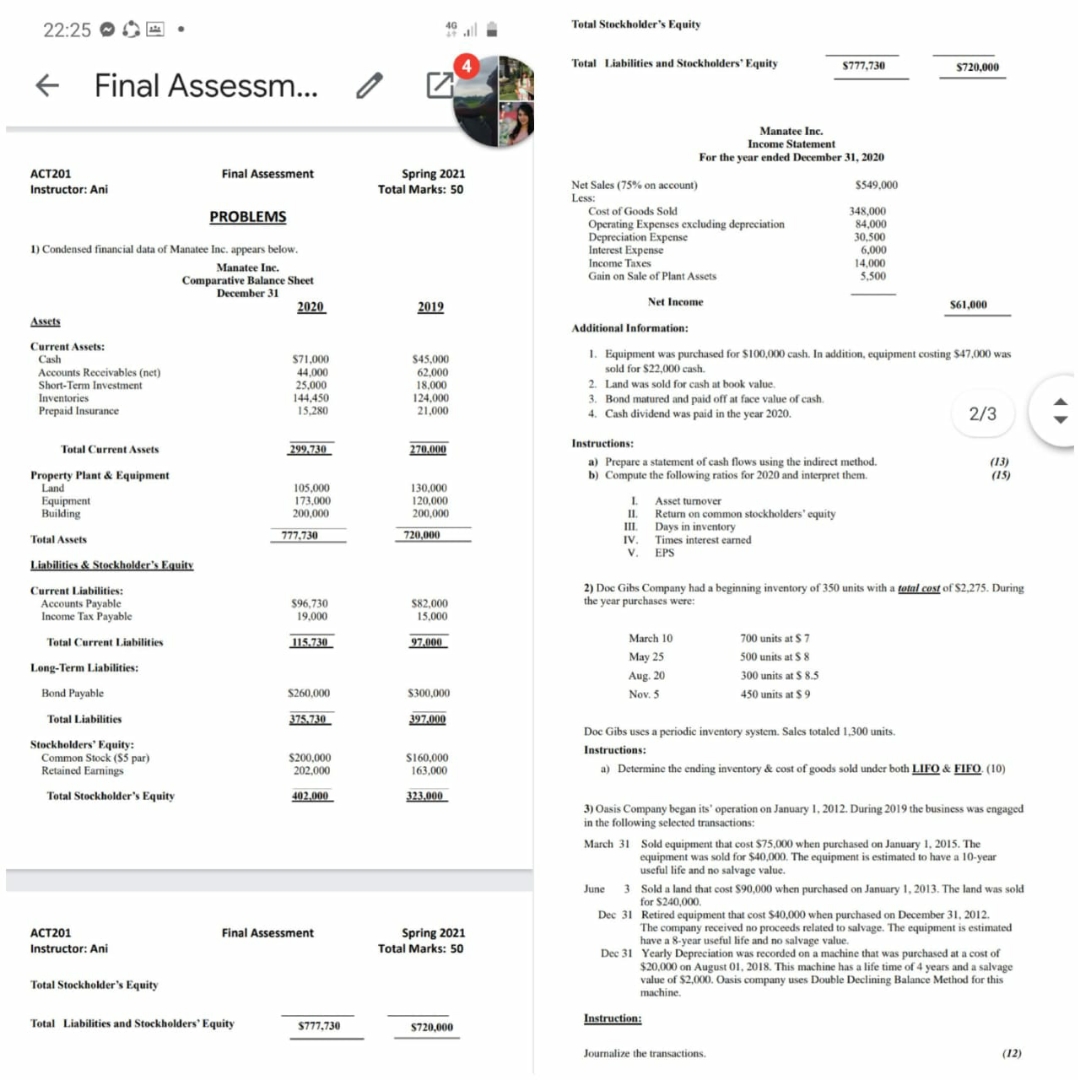

22:25 0 0 . Total Stockholder's Equity Total Liabilities and Stockholders Equity $777,730 $720.000 Final Assessm... Manatee Inc. Income Statement For the year ended December 31, 2020 ACT201 Final Assessment Spring 2021 Instructor: Ani Total Marks: 50 Net Sales (75% on account) $549.000 Less: PROBLEMS Cost of Goods Sold 348,000 Operating Expenses excluding depreciation 84.000 Depreciation Expense 30 500 1) Condensed financial data of Manatee Inc. appears below Interest Expense 6.000 Manatee Inc. Income Taxes 14,000 Comparative Balance Sheet Gain on Sale of Plant Assets 5.500 December 31 2020 2019 Net Income $61,000 Assets Additional Information: Current Assets: Cash $71,000 $45,000 Equipment was purchased for $100,000 cash. In addition, e ment costing $47,000 was Accounts Receivables (net) 44,000 62.000 sold for $22,000 cash. Short-Term Investment 25,000 18,000 2. Land was sold for cash at book value. Inventories 144,450 124,000 Bond matured and paid off at face value of cash. Prepaid Insurance 15.280 21.000 4. Cash dividend was paid in the year 2020. 2/3 Total Current Assets 299,730 270.000 Instructions: a) Prepare a statement of cash flows using the indirect method. (13) Property Plant & Equipment b) Compute the following ratios for 2020 and interpret them. (15) Land 105,000 130,000 173,000 120,000 Asset turnover Building 200,000 200,000 Return on common stockholders' equity Total Assets 777.730 720,000 Days in inventory IV. Times interest earned EPS Liabilities & Stockholder's Equity Current Liabilities: 2) Doc Gibs Company had a beginning inventory of 350 units with a total cost of $2,275. During Accounts Payable 596,730 $82,000 the year purchases were; Income Tax Payable 19.000 15,000 Total Current Liabilities 115.730 97.000 March 10 700 units at $ 7 May 25 500 units at $ 8 Long-Term Liabilities Aug. 20 300 units at $ 8.5 Bond Payable $260,000 $300,000 Nov. 5 450 units at $ 9 Total Liabilities 375.730 397.000 Doc Gibs uses a periodic inventory system. Sales totaled 1,300 units. Stockholders' Equity: Common Stock ($5 par) $200,000 $160,000 Instructions: Retained Earnings 202.000 163.000 a) Determine the ending inventory & cost of goods sold under both LIFO & FIFO. (10) Total Stockholder's Equity 402.000 323.000 3) Oasis Company began its' operation on January 1, 2012. During 2019 the business was engaged in the following selected transactions: March 31 Sold equipment that cost $75,000 when purchased on January 1, 2015. The equipment was sold for $40,000. The equipment is estimated to have a 10-year useful life and no salvage value. June 3 Sold a land that cost $90,000 when purchased on January 1, 2013. The land was sold for $240,000. Dec 31 Retired equipment that cost $40,000 when purchased on December 31, 2012. ACT201 Final Assessment Spring 2021 The company received no proceeds related to salvage. The equipment is estimated Total Marks: 50 have a 8-year useful life and no salvage value. Instructor: Ani Dec 31 Yearly Depreciation was recorded on a machine that was purchased at a cost of $20,000 on August 01, 2018. This machine has a life time of 4 years and a salvage Total Stockholder's Equity value of $2,000. Oasis company uses Double Declining Balance Method for this machine. Total Liabilities and Stockholders Equity $777,730 $720,000 Instruction: Journalize the transactions. (12)