Question: please solve it all requirements i have not much time to post again and again i have only 2 hours please all requirements 3:08 PM

please solve it all requirements i have not much time to post again and again i have only 2 hours please all requirements

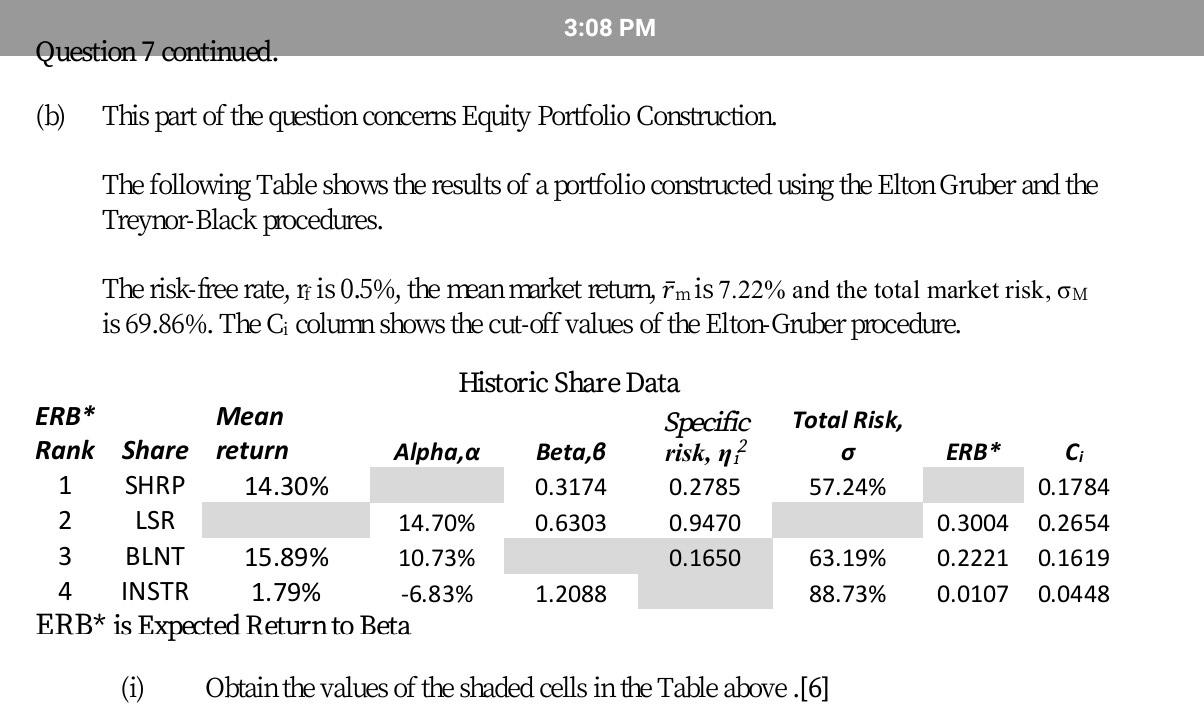

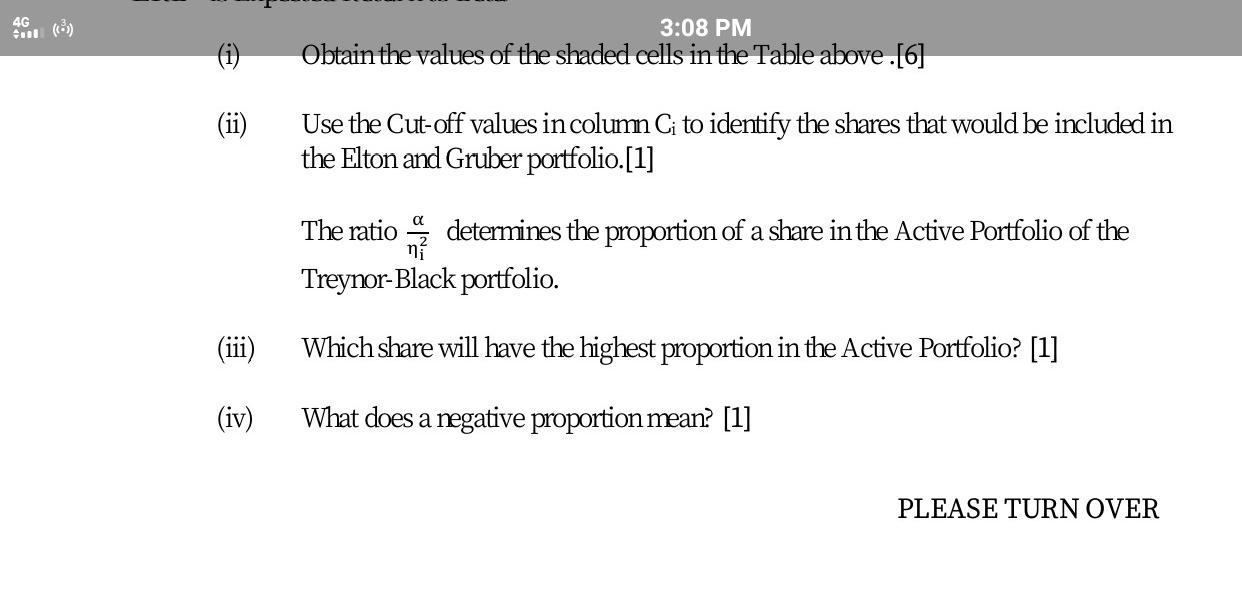

3:08 PM Question 7 continued. (b) This part of the question concerns Equity Portfolio Construction. The following Table shows the results of a portfolio constructed using the Elton Gruber and the Treynor-Black procedures. The risk-free rate, rf is 0.5%, the mean market return, imis 7.22% and the total market risk, om is 69.86%. The C column shows the cut-off values of the Elton-Gruber procedure. ERB* Total Risk, o ERB* Ci 57.24% Historic Share Data Mean Specific Rank Share return Alpha,a Beta, 6 risk, n? 1 SHRP 14.30% 0.3174 0.2785 2 LSR 14.70% 0.6303 0.9470 3 BLNT 15.89% 10.73% 0.1650 4 INSTR 1.79% -6.83% 1.2088 ERB* is Expected Return to Beta 0.1784 0.2654 0.3004 63.19% 0.2221 0.0107 0.1619 0.0448 88.73% (i) Obtain the values of the shaded cells in the Table above. [6] 4G Cal( (i) 3:08 PM Obtain the values of the shaded cells in the Table above.[6] (ii) Use the Cut-off values in column Ci to identify the shares that would be included in the Elton and Gruber portfolio.[1] The ratio determines the proportion of a share in the Active Portfolio of the Treynor-Black portfolio. (iii) Which share will have the highest proportion in the Active Portfolio? [1] (iv) What does a negative proportion mean? [1] PLEASE TURN OVER 3:08 PM Question 7 continued. (b) This part of the question concerns Equity Portfolio Construction. The following Table shows the results of a portfolio constructed using the Elton Gruber and the Treynor-Black procedures. The risk-free rate, rf is 0.5%, the mean market return, imis 7.22% and the total market risk, om is 69.86%. The C column shows the cut-off values of the Elton-Gruber procedure. ERB* Total Risk, o ERB* Ci 57.24% Historic Share Data Mean Specific Rank Share return Alpha,a Beta, 6 risk, n? 1 SHRP 14.30% 0.3174 0.2785 2 LSR 14.70% 0.6303 0.9470 3 BLNT 15.89% 10.73% 0.1650 4 INSTR 1.79% -6.83% 1.2088 ERB* is Expected Return to Beta 0.1784 0.2654 0.3004 63.19% 0.2221 0.0107 0.1619 0.0448 88.73% (i) Obtain the values of the shaded cells in the Table above. [6] 4G Cal( (i) 3:08 PM Obtain the values of the shaded cells in the Table above.[6] (ii) Use the Cut-off values in column Ci to identify the shares that would be included in the Elton and Gruber portfolio.[1] The ratio determines the proportion of a share in the Active Portfolio of the Treynor-Black portfolio. (iii) Which share will have the highest proportion in the Active Portfolio? [1] (iv) What does a negative proportion mean? [1] PLEASE TURN OVER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts