Question: Please solve it and put the steps and please make it so clear please I didn't understand anything Q1 ) ABC Corp has the above

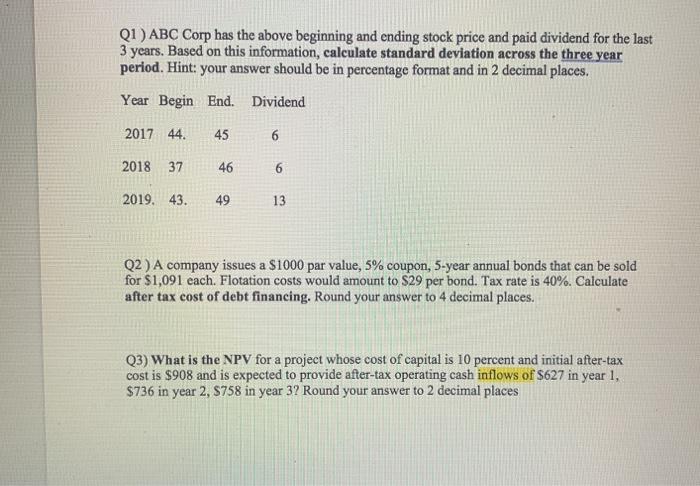

Q1 ) ABC Corp has the above beginning and ending stock price and paid dividend for the last 3 years. Based on this information, calculate standard deviation across the three year period. Hint: your answer should be in percentage format and in 2 decimal places. Year Begin End. Dividend 2017 44. 45 6 2018 37 46 6 2019. 43. 49 13 Q2 ) A company issues a $1000 par value, 5% coupon, 5-year annual bonds that can be sold for $1,091 each. Flotation costs would amount to S29 per bond. Tax rate is 40%. Calculate after tax cost of debt financing. Round your answer to 4 decimal places. Q3) What is the NPV for a project whose cost of capital is 10 percent and initial after-tax cost is $908 and is expected to provide after-tax operating cash inflows of S627 in year 1, $736 in year 2, S758 in year 3? Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts