Question: please solve it as soon as possible PROBLEM 1 Capezza Corporation has a positive balance in Accumulated E&P of $78,000 and a positive balance in

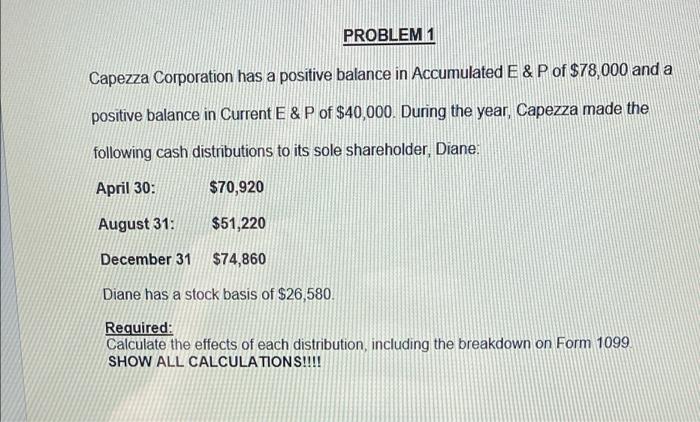

PROBLEM 1 Capezza Corporation has a positive balance in Accumulated E&P of $78,000 and a positive balance in Current E & P of $40,000. During the year, Capezza made the following cash distributions to its sole shareholder, Diane: April 30: $70,920 August 31: $51,220 December 31 $74,860 Diane has a stock basis of $26,580. Required: Calculate the effects of each distribution, including the breakdown on Form 1099 SHOW ALL CALCULATIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts